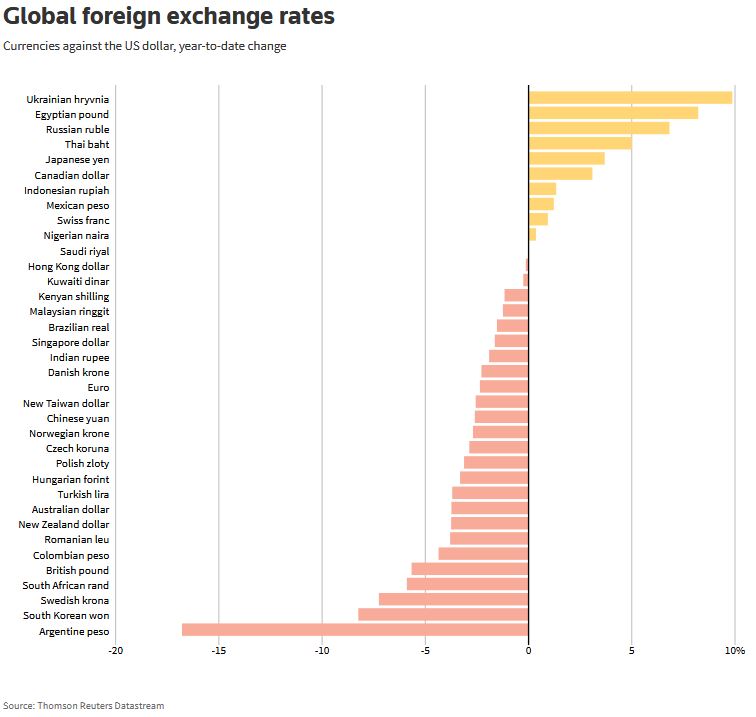

Investors rushed into gold Monday, safe haven yen and bonds as they worried about a continuing US-China trade war and global growth. Argentina's peso fell by 15% after voters made a memo to the president.

The yen rose to its highest level in more than one-and-a-half years against the dollar, as the Japanese currency was expected to gain more in the event of a protracted trade conflict between the US and China.

The yen rose to its highest level in more than one-and-a-half years against the dollar, as the Japanese currency was expected to gain more in the event of a protracted trade conflict between the US and China.

Concerns that a trade deal could not be reached ahead of the US presidential election 2020 grew after Goldman Sachs lowered its growth prospects for the US last Sunday and warned that a post-election trade would increase in strength.

Wall Street stocks slipped more than 1%, almost negatively impacting global equity performance. Before that, stock prices in China rose more than 1% as the yuan prevented another drama after the Chinese authorities allowed the yuan to fall below the seven-dollar level last week.

In the short term, the stocks lack a catalyst that results from either corporate earnings, the Federal Reserve, or a trade agreement, said Rahul Shah, CEO of Ideal Asset Management, New York.

"The promise of a trade deal this year is becoming increasingly unlikely in my opinion," said Shah. "The market may be preparing for a correction," he said.

Stocks could fall between 5% and 10%, but cause long-term investors to enter the market when valuations fall, he said. Half of Shah's portfolio is corporate bonds the other half are technology stocks and stocks with solid dividends, he said.

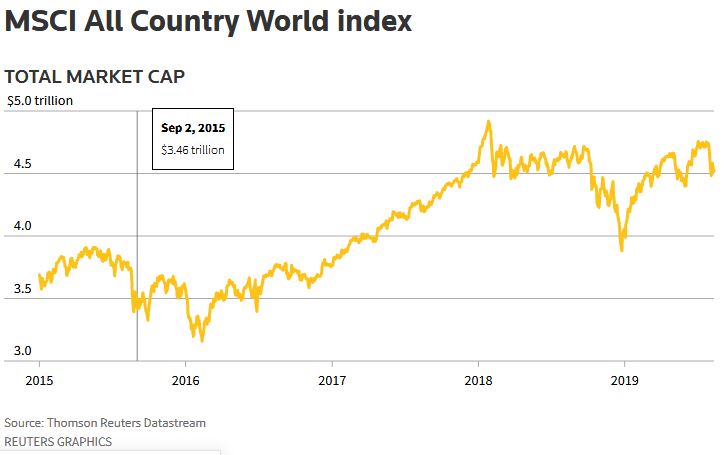

The MSCI index for stock performance in 47 countries fell 0,85% on a decline in US stocks. The benchmark index S&P 500 is now almost 5% below its all-time high, which was only reached XNUMX trading days ago.

The MSCI index for stock performance in 47 countries fell 0,85% on a decline in US stocks. The benchmark index S&P 500 is now almost 5% below its all-time high, which was only reached XNUMX trading days ago.

The Dow Jones Industrial Average was down 391 points, or 1,49%, to 25.896,44. The S&P 500 lost 35,96 points or 1,23% to 2.882,69 and the Nasdaq Composite lost 95,73 points or 1,2% to 7.863,41.

European equities also fell. The supraregional FTSEurofirst 300 of the leading European stocks closed at 0,31%, while the export-strong German DAX fell by 0,12%.

The ifo survey in Germany confirmed the growth concerns as both current conditions and economic expectations deteriorated in the third quarter.

Gold rose and stayed above the psychological level of 1.500 USD. Spot gold gained 1,1% to 1.512,51 USD per ounce.

The yen has surged against the dollar to its highest level since March 2018 - with the exception of a flash crash in January - and gained 0,37% against the greenback at 105,30 per dollar.

The Euro was up 0,11% on 1,121 USD, while the Dollar Index fell by 0,07%.

The Euro was up 0,11% on 1,121 USD, while the Dollar Index fell by 0,07%.

"The longer the trade war lasts, the more likely it will hurt the global outlook and the world economy, negatively impacting market morale," said Joe Manimbo, senior market analyst at Western Union Business Solutions.

US Treasury yields fell across the board as worries over trade and political tensions around the world in countries such as Hong Kong and Argentina helped asset safety.

Long-term US yields have fallen in six of the last nine trading days, reflecting investors' reduced risk appetite. Bond yields in Europe were also lower during the day.

The benchmark of 10-year US Treasury bonds rose 28/32 to bring their return down to 1,6386%.

The Argentine peso collapsed and fell to 55,85 dollars after voters pushed market-friendly President Mauricio Macri under pressure, giving the opposition a better-than-expected victory in Sunday's primaries.

The Merval stock index fell by 30% and a decline in 10 year-old benchmark bonds by 18 to 20 cent caused the US dollar to close at or below 60 cents.

The victory of Alberto Fernandez - whose deputy is the former Argentine President Cristina Fernandez de Kirchner - "paves the way for a return to left-wing populism, which many investors fear," the consulting firm Capital Economics told clients.

Oil prices rose despite concerns about a global slowdown and continued trade war between the US and China, which has lowered demand for commodities such as crude oil.

The international benchmark Brent crude oil futures rose 4 cents to 58,57 per barrel, while US West Texas Intermediate (WTI) futures gained 43 cents to 54,93 per barrel.

Reporting by Herbert Lash with additional reporting by Kate Duguid in New York; Editing by Cynthia Osterman - Reuters (picture and text) Translation: Institute for Rare Earths and Metals