Rare earths: China is firmly in the saddle, despite the Pentagon investing millions

China keeps a tight watch over its dominant position in rare earths and the production of permanent magnets, which are relevant to climate technologies and the military. An Asia expert warns that China is exerting influence on western industry, which hardly exists, through hidden ties.

Mike Pompeo traveled to Barcelona at the end of June. Not about the artistic buildings Antoni Gaudi to admire, but to open the annual meeting of the Rare Earth Industry Association (REIA). The ex-CIA chief is a special adviser to USA Rare Earth (USARE). Before that, he was Secretary of State under Donald Trump, who declared a national emergency in September 2020 because the “unacceptable dependence of the USA on critical minerals from foreign opponents” – meaning China – posed an extraordinary threat.

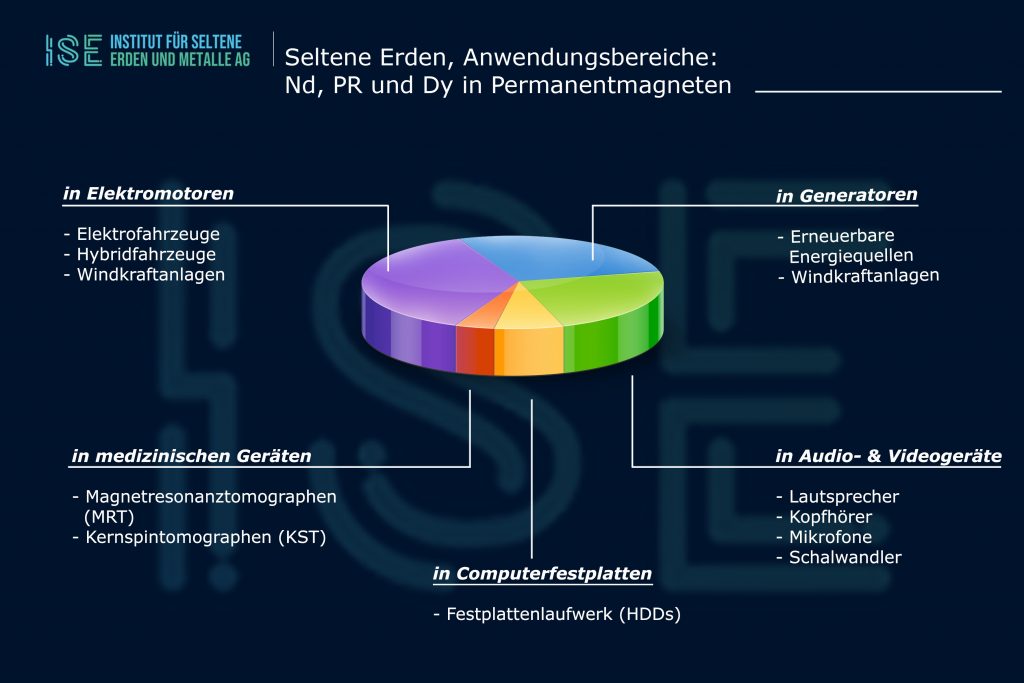

Trump is no longer president, but his commodities policy is being continued by successor Joe Biden. Of the 35 commodities critical to the US, rare earths stand out. Rare earths are also critical for the EU. But why all the hype about this group of 17 elements, most of which are only found in tiny amounts in loudspeakers, screens,glasses, alloys and hard disks occur? The argument is that with the massive expansion of climate technologies, demand will increase exponentially. This primarily refers to permanent magnets that are used in electric cars and wind turbines.

Dangerous dependence on China

China controls the market for the mining and further processing of rare earths up to the production of permanent magnets. This is increasingly becoming a problem for the West, because China is using its market power and throttles again and again Exports, last in morningh year as a reaction to the export ban decided by the USA, Japan and some EU countries für semiconductor technologies. Now the export of gallium and germanium is limited by China's export restrictions. On this topic we will report separately and in detail.

This dependency is particularly annoying for the US. Until the 1980s, the USA was the main producing country for rare earths. "But China used an aggressive economic policy to flood the world market with rare earths and squeeze out competitors," says Trump's decree of 2020. Today, the world power imports 80 percent of its needs from China.

The know-how fÜR Permanent magnets, originally from the USA. Today it has to be laboriously reconquered by China. One company working on this is Pompeo's USARE, which wants to set up vertical production from the mine to finished permanent magnets in Texas.

Tesla does not use rare earths

Despite efforts in the US and EU to regain control over rare earth production and downstream industries, more and more manufacturers are shunning electric motors based on permanent magnets. The reasons are extreme price fluctuations, the prospect of scarcity and the environmentally harmful mining. BMW dispensed with his electric motors the fünth generation of neodymium-iron-boron magnets. Nissan and Renault want to reduce the proportion of motors with permanent magnets. And e-car top dog Tesla does without rare earths in its new generation of electric motors.

In the wind industry, the proportion of systems with permanent magnets in Germany is low. In the case of offshore systems, the expansion of which is being massively promoted, however, models with permanent magnets are in the fast lane due to their resilience. It is not clear which generator type will prevail in wind turbines. In any case, raw material security is a big issue in the industry and probably the reason why German manufacturers of permanent magnets have moved away again. An exception is the market leader for onshore systems Enercon. In any case, the developments show that climate technologies do not necessarily have to be the drivers of demand for rare earths.

Neither clean nor transparent

The wind industry and the electric car industry advertise with clean energy and mobility. The mining of rare earths and the production of permanent magnets is usually neither very clean nor transparent. The origin of the rare earth elements used in permanent magnets cannot be traced back with certainty.

The fact that China was able to secure the monopoly for rare earths also has to do with the long-lax approach to environmental protection. This has made China's products unbeatably cheap. The problem with mining and processing is not only the release of radioactive substances such as thorium and uranium, but also the mining methods, especially for the heavy rare earths.

Thousands of poison pools in Burma's conflict zones

Kleine, runde Basins filled with poisonous water litter in Chinas southeastern province of Jiangxi whole landscapes. These are leftover leaches in which the rare earth ores have been treated with a chemical mix. tons on ammonium sulfates and ammonium chloride were injected directly into the ground until a few years ago in order to get to the coveted heavy rare earths. The rehabilitation of nature could take up to 100 years. The government estimates the costs for this at 5,5 billion US dollars.

The Chinese government has been trying to get a grip on the environmental problems associated with the mining of rare earths since 2016. Mines were closed, production cut back and crackdown on illegal mining. But with the closure of its mines, global demand has not diminished. So that China's refineries can continue to supply the world market, they source the substance from neighboring Myanmar (Burma). In just a few years, the country has advanced to become one of the largest mining countries for rare earths. Militia groups close to the military dictatorship control the mining – together with Chinese companies. The NGO Global Witness has in March 2022 with the help of satellite images 300 different sites with a total of 2.700 pools recorded for in situ leaching. The damage to the environment and the consequences for the people living there are devastating.

Pentagon invests millions

The USA and the EU put their raw material policy at the top of the state agenda at about the same time. But unlike in the EU, where securing raw materials is justified with the fight against climate change, the US government is primarily concerned with this the national security. The US has already mobilized over $100 million in public investment to bring rare earth mining and downstream industries back into the country. The Pentagon is responsible for this, because it is primarily fighter jets and nuclear submarines that need large quantities of rare earths. Each F-35 fighter jet weighs 420 kilograms, and a Virginia-class nuclear submarine, of which Australia ordered five from the USA last year, even more than four tons.

Even before Trump's wake-up call, the US company MP Materials can Mountain pass mine Taken over and put into operation in 2017. However, the USA is by no means independent of China: in the first three quarters of 2022, MP Materials' sales were based almost entirely on the sale to the semi-state Chinese company Shenghe Resources, which is also a minority shareholder of the US company.

China dominates rare earths not only on the sales side, but also as a buyer. What is special about this industry is China's presence at every stage in the supply chain, which makes it difficult for other countries to enter, quoted the Quartz news portal Andy Mok from Center for China and Globalization. The Pentagon approved MP Materials hence $35 million for the construction of a separation plant für heavy rare earths - despite Chinese participation.

Lynas Rare Earths is another of the rare earth producers outside of China. The company operates in the wesaustralirule Mount Weld a mine and separation plant for light rare Erden in Malaysia. Because of the radioactiven depall, the arise during the separation process, threatens Malaysien them Work revoke the license to operate. Lynas will soon be able to switch to his almost finished facility in Australia. In addition, Lynas is planning its own with the US chemical company Blue Line in Texas first separation plant für heavy rare earths. Here, too, the Pentagon is providing financial support and investing 1$20 million. Lynas will get $30 million for another light rare earth separation plant in Texas.

The Chinese government watch however zealüright and their monopoly, which they have built up over decades. Western Remühung, the control üabout rare earthsüto win back, do not remain unanswered. As early as 2009, the state-owned China Nonferrous Metal Mining tried to take over the majority of Lynas. The deal fell through because of Australian Behörden. Today, according to the US Department of Defense, Chinese actors are also engaging in disinformation campaigns. The hacker group Dragonbridge, which is close to Beijing, is said to have done so against Lyna's mood on the Internet.

In 1992, Party Secretary-General Deng Xiaoping proclaimed, "The Middle East has oil, China has rare earths." The long-term goal of the communist party is the leap from raw materials supplier to technology leader. Three years after Deng's legendary sentence, two Chinese state-owned companies, with the help of the US Sextant Group, took over the only US manufacturer of permanent magnets: the General Motors subsidiary Magnaquench. China thus secured access to important patents. A few years later, the new owners of Magnaquench closed all US locations by 2000, despite agreements to the contrary. Today, China controls over 90 percent of the global permanent magnet industry. Asia expert Frank Jüris from the Estonian Foreign Policy Institute points to the close ties between political leadership and industry: one of the two Chinese companies at the time was Deng Xiaoping's son-in-law, Zhang Hong.

Hidden ties with China

The second notable separation plant for rare earths outside of China is located in Estonia. A heritage from the Soviet era, Silmet is now owned by Neo Performance Materials (Neo). The Canadian listed company plans to expand the plant and also wants to produce permanent magnets in the future. Silmet was previously owned by Molycorp, which was formed in 2008 with the goal of rebuilding the entire supply chain from mine to permanent magnets in the US. Molycorp rebuilt the Mountain Pass mine and bought back Magnaquench from the Chinese. But Molycorp failed when China flooded the market with rare earths in 2015. The fall in prices forced the US company into bankruptcy. Neo took over Magnaquench and Silmet from the bankruptcy estate.

Jüris emphasizes that both MP Materials and Neo are intertwined with China. Neo's Australian majority owner Tattarang, which in turn is owned by Fortescue Metals Group, has a long history of close business ties with China. The fact that Neo is the only Western company allowed to process rare earths in the country is another indication of the close ties with the Communist Party. Magnaquench's R&D department will also be headed by Chen Zhongmin. He had previously worked for companies related to the Chinese military. Jüris warns that the Chinese government can theoretically exert influence on Western industry through these links if this is not stopped by regulation.

Scandinavia advances supply chain independent of China

Earlier this year, LKAB, Sweden's state-owned iron ore company, made headlines by announcing the largest deposit of rare earths in the EU. Since the main degradationproduct will continue to be iron ore, "it makes the mining of rare earths independent of volatile world market pricesscary", said LKAB special adviser Bo Krogvig in an interview with the Tagesspiegel Background.

In order to separate the rare earths, LKAB has bought the majority of REEtec. The Norwegian company plans to commission its first separation plant in 2024. The ore for this is said to come from Canada from Vital Metals. A second plant is scheduled to start up for LKAB in 2026, but LKAB does not expect the rare earths to be mined in Kiruna before 2030. The US government also has a stake in REEtech through Mercuria. According to Reuters, German automotive supplier Schaeffler has signed a supply agreement with REEtec. It would thus be the first value chain to be completely independent of China. However, many experts doubt that it will be possible without China. After all, well over 90 percent of permanent magnets are produced there. China thus remains the most important buyer of rare earth oxides for the time being.

ISE AG – Arndt Uhlendorff – July 2023