E-car batteries: Nickel from Indonesia instead of Russia

The demand for nickel for cathodes will multiply by 2030. So far, the emerging EU battery industry has been dependent on Russian nickel. Because of the war in Ukraine, nickel from Indonesia is very popular. There, however, mining threatens primeval forests and isolated indigenous peoples.

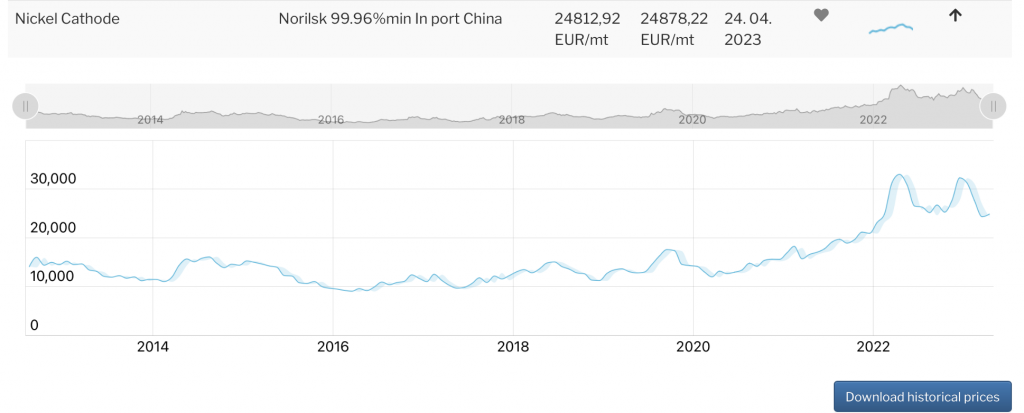

The price has tripled in the last 10 years. Nickel Cathode, Norilsk 99,96%. Source: https://ise-metal-quotes.com

Joko Widodo's popularity is not limited to his home country of Indonesia, but has now spread to Western governments as well. The President of the largest Southeast Asian country recently visited Germany, where he opened the world's largest industrial trade fair in Hanover together with Federal Chancellor Olaf Scholz. In the opening speech, the German chancellor promised to do his utmost to bring the free trade agreement between Indonesia and the EU, which has been negotiated since 2016, across the finish line by the end of this year.

Scholz and the EU are in a hurry because of the rich nickel deposits that the island state has. Indonesia mined 1,6 million tons of nickel in 2022, almost half of global production. The world's largest nickel reserves are also located here. The metal is of great interest for the automotive industry and its electrification. In batteries for electric cars, nickel is part of the cathode and provides higher energy density, storage capacity and range at a lower cost, according to the Nickel Institute. With a share of around two thirds, however, the steel industry is currently the largest consumer of nickel. In contrast, around ten percent went to the battery industry in 2022. However, with the switch from combustion engines to electric cars, the demand for nickel from the battery sector is forecast to multiply by 2030.

Protectionism annoys the EU

However, as is so often the case with critical metals, the rush in the EU comes far too late. In Indonesia, too, China has long since staked out its territories. Indonesia's nickel deposits are concentrated on the islands of Sulawesi and Halmahera, where a number of Sino-Indonesian joint ventures mine and process nickel in on-site nickel smelters. In order not to fall into the raw material trap and only export the ore cheaply, Indonesia tried as early as 2009 to further process nickel in the country. Widodo's goal is to set up his own battery production and ultimately also to bring the production of electric cars to his country. Indonesia is well on the way there.

In 2014, Indonesia even issued an export ban for nickel ores, which alienated international trading partners. The move also hit China, which has been importing Indonesian nickel ore for its steel industry for decades. But the Chinese took it sporty. They complied and began investing billions in Indonesian nickel smelters. The EU, on the other hand, complained to the World Trade Organization and sued the export restrictions. Against this background, Olaf Scholz's words are not very credible when he hinted in his opening speech in Hanover that countries like Indonesia benefited far too little from their raw materials because of China and that the EU now wants to change that.

Indonesia meets Europe's rush, because the island state needs investments to make money from the electric car boom. Widodo's industrial strategy, including protectionist measures, is working. Today, Indonesia is not only the largest mining country, but also number one in the production of refined products. Nickel consumption is a telling indicator of advancing industrialization: Indonesia is now the second largest nickel consumer after China – in 2013 the country was still in 15th place in an international comparison.

Human rights: BASF hesitates on Indonesia project

During his visit to Germany, Widodo met with senior management at BASF and tried to address environmental concerns surrounding nickel mining. The chemical giant is about to sign a €2,4 billion deal with French mining company Eramet to build a nickel-cobalt refinery complex on the island of Halmahera. The project will consist of a high-pressure acid leaching (HPAL) plant and base metals refinery, which will produce 67.000 tonnes of nickel and 7.000 tonnes of cobalt per year for the battery industry. It should start at the beginning of 2026. However, the final talks seem to be faltering. The reason could be a report by the NGO Survival International, according to which nickel mining and its negative effects on the environment are threatening an indigenous tribe, the Tobelo Dalam people, some of whom have little contact with the outside world.

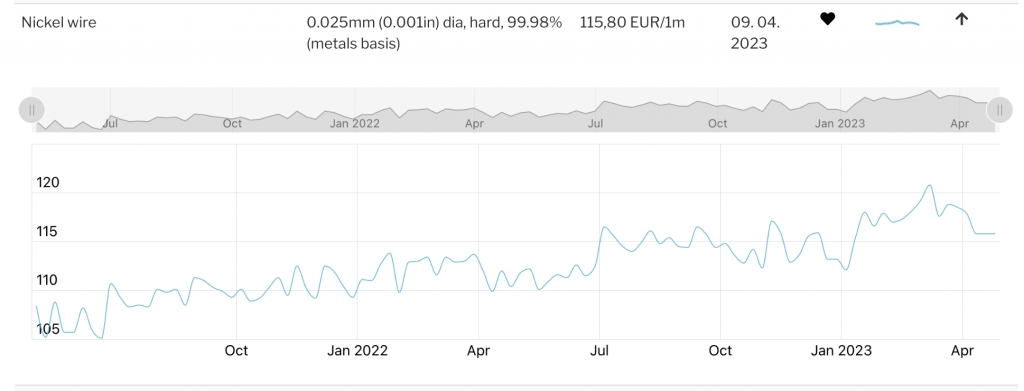

Price history of Nickelwire 0,025mm 99,98%. Nickel wire of this thickness is used for the latest generation of car batteries. Source: https://ise-metal-quotes.com

The Weda Bay Nickel (WBN) mine near the Weda Bay Industrial Park on Halmahera has been operational since 2019. Eramet has a 39 percent stake in WBN, while the Chinese steel company Tsingshan is the majority owner with 51 percent. The remaining ten percent belong to the Indonesian government. The fact that nickel mining on Halmahera causes environmental problems and social conflicts should not be new to Eramet. The French have been involved in WBN since 2006 and in 2010 a group of Indonesian NGOs complained about the project because it would have a negative impact on the environment and the islanders. Even then, the NGOs explicitly emphasized the risks for the Tobelo Dalam, which the company did not take seriously enough.

Asked about this by the Business & Human Rights Resource Center on April 14, BASF responded that the concerns raised by Survival International are part of the ongoing risk assessment and assessment. The group relies on its commitment to high ESG standards. A final decision, which BASF has not yet made for the project, will take these aspects into account, the letter said. Eramet says it has been in contact with the forest-dwelling tribe affected by the 45.000-hectare concession for years and questions the existence of any wholly uncontacted individuals believed to be living in or near the concession. Eramet commissioned studies and hired an anthropologist to ensure peaceful and respectful coexistence.

US electric car maker Tesla, which is planning a car factory in Indonesia because the country offers large quantities of cheap nickel, has also come under criticism. This is because some of the mining and refining projects have dumped the vast amounts of overburden and refinery waste into the sea. A controversial practice that pollutes coastal ecosystems with heavy metals that are currently no longer sanctioned by Indonesia. Officially, the government has not yet issued a ban, such as Eramet is demanding. Instead of disposing of the mining waste in the sea, Eramet wants to deposit it on land in a dry state. This method also carries risks due to the tropical climate with high precipitation, the specific topography of the island nation and the high seismic activity in the region, or correspondingly much higher costs.

Volkswagen wants to get involved in Indonesia

The allure of Indonesian nickel and Widodo's powers of persuasion currently outweigh environmental and human rights concerns. After the Indonesian President met with BASF representatives, an appointment was also made with VW. The VW Group is also interested in Indonesian nickel. According to the Indonesian investment minister, the German carmaker wants to build a battery ecosystem in the Southeast Asian country and join a consortium that includes Ford, Vale and Chinese battery metal producer Zhejiang Huayou Cobalt. Ford, in turn, came under criticism in his home country, where the Inflation Reduction Act is intended to reduce dependencies on China, among other things. The carmaker licenses Chinese technology from CATL for battery production in Indonesia.

In any case, BASF is eyeing Indonesia's nickel for a good reason: The chemical company is planning a plant in Harjavalta, Finland, for the production of cathode precursors. Nornickel Harjavalta, the Finnish subsidiary of the Russian mining and metals group Nornickel, supplies the nickel for this. Its headquarters are in Norilsk, in the Arctic. The metal has been mined in the once “closed” city, which cannot be reached by land, since the days of Stalin.

Nornickel: "Too big to sanction"

Although Great Britain put Vladimir Potanin, majority owner of Nornickel and, according to the US, a close confidant of Putin, on the sanctions list in July 2022, no Western sanctions have been imposed on Nornickel himself. Nevertheless, business for the group in the West is becoming increasingly difficult. The Finnish state railway company VR let its supply contract with Nornickel expire at the end of 2022 and did not renew it. And there were already interruptions to deliveries in 2022. At the end of January this year, the Russian news agency Tass reported that Norilsk Nickel Harjavalta had signed a new contract with a Finnish railway company to transport Russian nickel to Finland by rail. The name of the company was not mentioned.

BASF wants to produce cathode material at the Schwarzheide site in Germany. The plant is part of BASF's plan to become the most important supplier of cathode material for the European e-car industry. Schwarzheide should be able to equip 400.000 fully electric vehicles with battery materials every year. But the Russian mining company Nornickel is a central part of this plan: in 2018, the chemical company entered into a partnership with Nornickel, which is manifested in Harjavalta. There, Nornickel operates a metal refinery in the immediate vicinity of the BASF factory and supplies the German group with Russian nickel. Benchmark Mineral Intelligence assumes that BASF will provide almost 20 percent of European cathode production capacities in the future. With nickel made in Russia.

Nornickel is the world's largest single producer, accounting for one-fifth of the world's nickel production, making Russia the third largest nickel producer in the world, after Indonesia and the Philippines. The EU in particular is dependent on Russia to ramp up its battery industry, which may be why Nornickel has so far been spared Western sanctions. "Too big to sanction" is the motto making the rounds in the Finnish media.

Philippines considers export restrictions

The difficult environment and a possible extension of sanctions to nickel from Russia also suits the second largest nickel producer in the world, the Philippines. This island state also wants to benefit from the electric car boom and the increasing demand for nickel. The new government under Ferdinand Marcos Jr. wants to continue the direction taken by his predecessor. Rodrigo Duterte lifted a moratorium on nickel mining that had come into effect four years earlier in December 2021. The Philippine government aims to triple its mining sector by 2027. The country stepped into the breach when Indonesia imposed an export ban on nickel ore and became China's number one nickel supplier. But the Philippines would also like to have more of the value chain and are considering introducing export restrictions on nickel ores, following the example of Indonesia.

ISE AG April 2023 – Arndt Uhlendorff