Export controls on gallium and germanium: “China wants to negotiate”

The export controls imposed by China on the high-tech elements gallium and germanium in the summer sent the economy into panic. According to a China expert, China only wants to gain room for negotiation in the technology war with this step.

Just 430 tons of gallium and around 225 tons of germanium were produced worldwide in 2022. Still, export controls on these two key items imposed by China in August spooked the global economy. The reason for the uproar is the use of gallium and germanium in high technologies on the one hand and the high concentration of production in China on the other. China's monopoly is particularly clear when it comes to gallium: “Ten of the 430 tons were produced outside of China. It is the greatest dominance of any single element on the planet,” says Alastair Neill, China expert and raw materials expert at the North American Critical Minerals Institute. China now produces almost 98 percent of the world's primary gallium. The country is estimated to be responsible for over 80 percent of the primary production of germanium.

Gallium arsenide is used in high-performance chips and semiconductors. Gallium also has the unique ability to convert electricity into light, which makes it so attractive for optoelectronics. This is primarily about 5G technology and ultra-fast fiber optic networks. Gallium is also used in smartphones, solar cells and satellites. Although much more expensive than silicon arsenide, which is the most common semiconductor material, manufacturers such as TSMC and Compound Materials from Saxony turn to gallium arsenide.

Negotiating points in the technology war

Beijing's leadership justified the export controls with national security. Michael Harz, Managing Director of Compound Materials, expects that buyers will now have to answer questions such as users, end users, end applications and the like. He did not believe that China was interested in an escalation because China also buys back processed gallium products, he told MDR.

Neill, who worked in China for seven years, confirms Harz's suspicions. “In this way, China can effectively control where the gallium goes.” He sees sober calculation behind the export controls and refers to the US ban on selling chip manufacturing machines to China. This is significantly slowing down the expansion of 5G networks in China. With the export controls on gallium and germanium, China probably wants to gain negotiating leverage in the technology war with the USA.

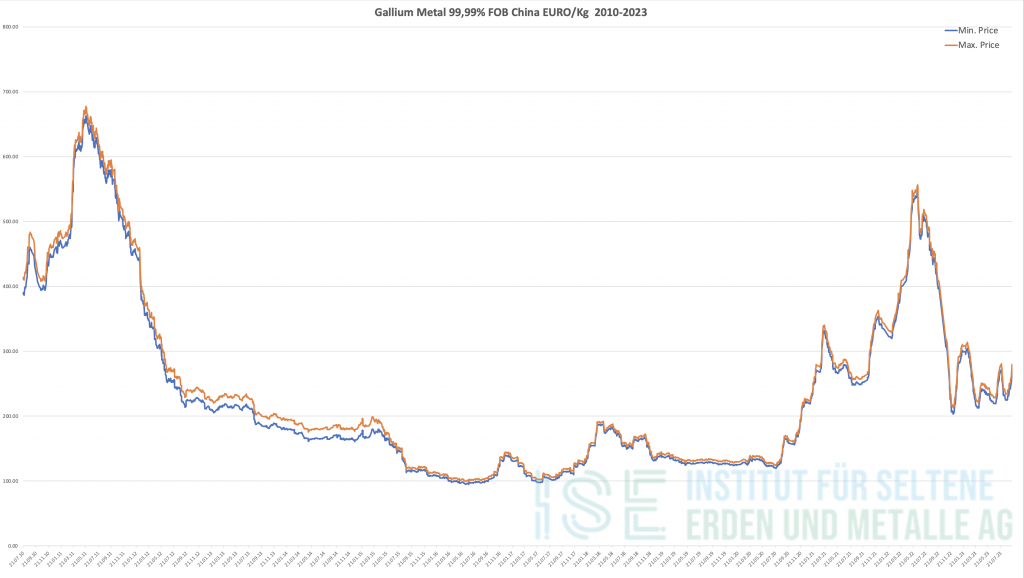

USA: No gallium stocks

The USA is caught off guard by export controls. “While the U.S. government has stockpiles of germanium, surprisingly it does not have gallium,” said Neill. The manufacturer from Saxony is different: Compound Materials has reserves that last for six months, reports MDR. At the same time, the market for pure gallium metal, estimated at $100 million per year, is so small that a decline in exports in China would hardly be economically noticeable. Due to the small size of the market, it is difficult for companies to invest in new mining projects.

According to the German Raw Materials Agency (Dera), germanium is primarily obtained from the smelting of zinc and copper sulfide ores and from coal. Gallium is a by-product of aluminum or zinc production, with bauxite production being the most economically important, accounting for 90 percent. According to Statista, China was the second largest bauxite producer in the world after Australia in 2022 and can therefore cover its own consumption. Guinea, which has the world's largest bauxite deposits, is also one of the top three producers.

Resumption of gallium production in Germany

In addition to the USA, the five largest importing countries include India, Japan, South Korea and Taiwan. According to Dera, Germany imported between 2020 and 2022 tons of gallium annually between 40 and 60, of which 50 to 60 percent came from China. The rest came mainly from Slovakia. The CMK company, which was founded in the 1970s, produces gallium and gallium arsenide in the small town of Žarnovica using specially developed recycling processes.

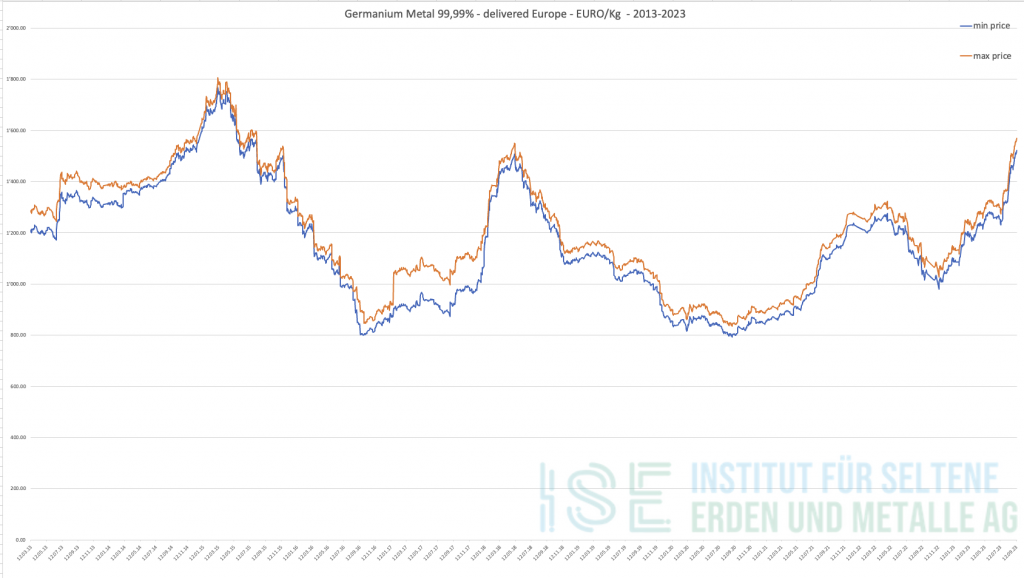

Until 2015, the Germany-based company Ingal Stade GmbH was the largest gallium producer outside of China. The company was located on the premises of Aluminum Oxid Stade GmbH (AOS Stade). Due to a drop in prices, Ingal Stade ceased production in 2016 and dissolved shortly afterwards. At the beginning of 2021, when gallium prices rose again, AOS Stade announced that, in addition to its aluminum production, it would resume gallium production by the end of 2021. However, this has not happened to date and the company did not provide any comment on the current status at the request of the Institute for Rare Earths.

Bauxite from Conakry to Stade

In 2022, the Neue Stader Wochenblatt reported that AOS Stade had applied to the Lüneburg Trade Inspectorate to increase the earth walls of its red mud dump from 16,5 to 30 meters. Currently only a maximum height of 21 meters would be permitted. The landfill is located about four kilometers west of the Elbe, where AOS Stade has its premises and harbor. The company sources the bauxite from Guinea, where a military coup took place in 2021. Since then, the military has run the country and deposed President Alpha Condé has been under house arrest. AOS Stade's parent company is Dadco, an aluminum company owned by British-Canadian businessman Victor Dadaleh and whose headquarters are registered in the Channel Islands. Dadco has a stake in the Compagnie des Bauxites de Guinee (CBG), one of the two largest bauxite producers in Guinea, through the aluminum group Halco, in which it holds a ten percent stake.

Even though gallium and germanium are produced in Canada, the USA, Belgium and Russia, according to Dera, the demand cannot be met by these countries in the short or medium term. So far, China is planning export controls, but not an export ban, emphasizes Dera expert Maren Liedtke, who warns of panic.

At the same time, the West does not have the ability like China to bring bauxite from various sources to a central location for processing in order to enable mass production of gallium. “We don’t get that kind of collaboration very well here in the West, where every company fights for itself,” says Neill.

ISE AG – Arndt Uhlendorff – September 2023