Scandium: From Soviet Secrets to China's Monopoly

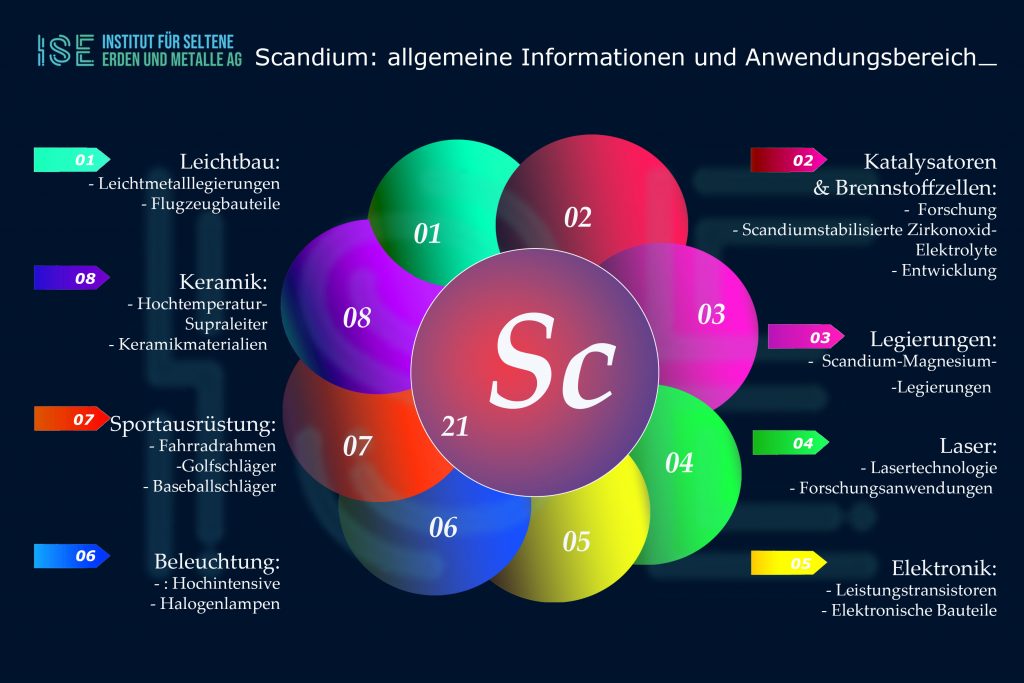

Because of the potentially high demand for climate technologies such as the hydrogen industry, the West is trying to produce its own production of the expensive rare earth metal. The aerospace and automotive industries could benefit from a safe and cheap supply of scandium.

A week ago, the second trilogue meeting on the Critical Raw Materials Act took place in Brussels, the raw materials law that is intended to secure Europe's industry access to critical metals. In the currently very tense geopolitical situation, large dependencies on a handful of countries represent a very high risk for Europe's economy. China in particular controls the mining and processing of numerous critical and strategic metals, but Russia is also dominant in the raw materials sector. The fact that China also uses its monopoly strategically is clearly demonstrated by the introduction of export controls on the technology metals gallium and germanium (see https://institut-seltene-erden.de/ausfuhrkontrollen-auf-gallium-und-germanium-china-will-verhandeln/ ). China has now extended export restrictions to graphite, the largest component of electric car batteries (lithium-ion accumulators).

Scandium is also another possible candidate for export restrictions, believes Alastair Neill from Critical Minerals Institute. Despite its abundance in the earth's crust, comes scandium rarely found in enriched form in nature. Therefore, there is no dedicated scandium mining, but rather the metal is obtained as a by-product from cobalt, nickel, titanium, uranium or zirconium mines.

Scandium production in China Blackbox

Similar to gallium and germanium, it is a niche metal with a very small market. Only a few countries mine the metal: China, Russia, Kazakhstan, and, before the outbreak of war in 2022, Ukraine, supply the world with 15 to XNUMX per year 25 tons. At least that's what the US estimates say US Geological Survey Geology Service, because there is no precise information. The market is too small and the use of the metal is too scattered, according to a report by the US Foreign Trade Administration. The actual production volumes in China that are intended for domestic consumption and not for export are unknown. Russia is also said to still have stockpiles from the Cold War era. What is certain is that China is the top dog in the scandium market.

Aluminum-Scandium: Weight reduction for aviation

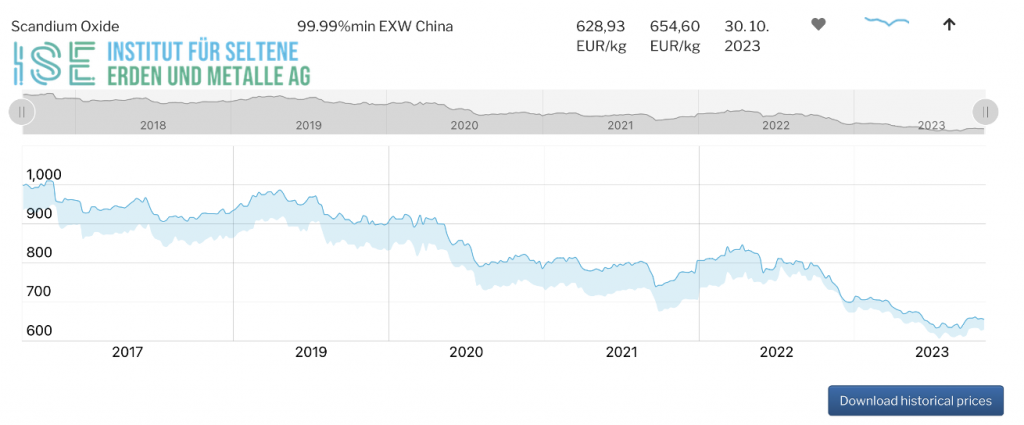

scandium would be very attractive for the industry and experts have been predicting a boom for the metal for years, but this has not materialized. As an alloy additive in aluminum, scandium, even in small amounts (approx. 0,2 percent), ensures that aluminum parts can be welded instead of riveted. This allows a weight reduction of ten to 15 percent, which is particularly relevant for the aerospace industry, where every kilogram less weight means savings of several hundred liters of fuel and therefore costs. But the high price, according to the Institute for Rare Earths and Metals AG (www.ise-ag.com) Database for scandium oxide 99,99% EXW China at EURO 654,60 and scandium metal 99,999% EXW China at EURO 5260, And the Supply risks prevent companies like Airbus from investing in scandium. Market observers therefore speak of a chicken-and-egg problem for scandium: because the supply is too small and too uncertain, there is no demand in the industry.

Its special properties – increase strength, flexibilityät, heat resistantädurability and corrosion protection – made the material a closely guarded secret in the Soviet Union during the Cold War. Researchers there recognized as early as the 1950s that scandium improved the qualities of aluminum. Scandium was used for the first time as an alloy additive in MiG-29 fighter jets. Until the 1990s, the Soviet Union was also the world's largest producer of scandium, where it was obtained primarily from uranium mines.

Rusal is the market leader

Even today, Russia is still a significant player when it comes to scandium, and not just in terms of its extraction. The aluminum company Rusal was the first manufacturer to succeed in economically extracting scandium oxide from red sludge. Rusal is also a pioneer in the development of scandium-aluminum technologies. Lfrom Maven Research is the third largest aluminum manufacturer, whose dazzling welcomeünder Oleg Deripaska is listed on Western sanctions lists, even the market leader for Scandium aluminum-Products. The group itself was also placed on the US sanctions list in 2018, but was removed again at the beginning of 2019 following ownership restructuring.

The company continues to face sanctions because of Russia's war against Ukraine, even though metal traders and banks have recently started stocking up on Russian aluminum again on the LME metal exchange in London. However, many Western companies avoid doing business with Rusal even without sanctions. The company therefore appealsärkt Asian markets and has its sights set on China's electric car industry, whose hunger for CO2-reduced aluminum is growing rapidly.

Scandium in electrolyte

The current one grHowever, the largest individual buyer of Russian scandium comes from a completely different place: the Californian fuel cell manufacturer Bloom Energy adds the element to the electrolyte in its solid oxide fuel cells. Scandium is also used in small quantities in the sporting goods industry, where it strengthens bicycle frames, lacrosse bats and baseball bats. It is also installed in small firearms. However, market observers see the greatest potential for scandium in the automotive industry, which has so far stayed away from aluminum-scandium alloys because of their high costs and lack of supply.

Germany: demand from the Hydrogen industry

The metal could also become important for the hydrogen industry. Grune, i.e. made with renewable energieser hydrogen currently makes less than one percent (40 terawatt hours) of global production. The demand will be in the future rise extremely. According to a study by the German Raw Materials Agency (Dera), the future belongs to green hydrogen production using water electrolysis, in which the gas is produced from water. Therefore be There are three electrolysis technologies of importance today, of which the alkaline Eelectrolysis and to a large extent polymer electrolysis membrane electrolysis are in a technically mature state. The FestköPeroxide electrolysis is currently in the transition between research and industrial application.

Scandium is only used in the latter: the solid electrolyte consists of either yttrium-doped or scandium-doped zirconium dioxide. According to Dera, the advantages of the scandium-doped material are better conductivityäability and the höhere stabilityät at lower operating temperatures. The Dera study says for scandium In a sustainable future scenario, demand will increase by 2040 to 24 tons, i.e. 2,7 times the production in 2018 (7 tons)..

Rio Tinto relies on scandium

For several years now, a number of Western companies have been trying to take the mining and production of scandium into their own hands. This could be a sign of a breakthrough in a few years. riotinto, a mining heavyweight, has been extracting scandium oxide since 2022 from waste generated during titanium oxide production in Quebec, Canada. The production capacity should be three tons per year, which, according to Rio Tinto, should correspond to around 20 percent of global production volume. The latter information should be viewed with caution, as the actual global production volumes are not precisely known.

The Japanese mining group Sumitomo Metal Mining, which is part of Japan's oldest and largest business conglomerate, has also commissioned additional production of scandium oxide in the Philippines at its nickel refinery, a high-pressure acid leaching plant (HPAL).

New nickel and cobalt refinery projects in Australia are already planning to extract scandium. There are also several mining projects downunder. Particularly worth mentioning is Platina Resources' platinum-scandium project, which Rio Tinto has agreed to purchase for $14 million. There are further projects from the junior mining companies Scandium International Mining and Sunrise Energy Metals in New South Wales. Sunrise Energy Metalsis also considering building a scandium refinery in the USA.

The near future will show whether the chicken-and-egg problem will be overcome. Until then, scandium will only be available to the world market in homeopathic quantities from China and Russia.

ISE AG – Arndt Uhlendorff – October 2023