Rare earths: EU relies on uneconomical mines

Kiirunavaara (Northern Sami: Gironvárri, Meänkieli: Kierunavaara) is a mountain in Kiruna Municipality in Norrbotten County, Sweden. It contains one of the largest and richest iron ore deposits in the world.

In its rush to become independent of China for critical raw materials, the EU agreed on a raw materials regulation in record time. Securing the sought-after materials should be achieved through raw material partnerships with third countries, more circular economy and the own extraction of critical raw materials within the EU. Domestic mining should therefore be ramped up in the EU by 2030 and cover at least ten percent of demand by then. According to Jan Moström, head of the Swedish state-owned iron ore company LKAB, the EU regulation could be a “game changer”. Moströms LKAB made many headlines in 2023 because of its well-known rare earth deposits in Kiruna.

The example of rare earths, a group of 17 elements in the periodic table that are critical for green technologies but also for military applications, shows how difficult it is for the EU to break through China's dominance in rare earths despite specific legislation, but also raises the question whether the EU is pursuing the right strategy with the Raw Materials Act. According to Eurostat, the EU imported 2022 tons of rare earths in 18.000, 40 percent coming from China, 31 percent from Malaysia and 25 percent from Russia. The USA and Japan each supplied the EU with two percent. However, the EU's dependence on permanent magnets is extremely high, at 83 percent. In 2023, the EU imported around 25.000 tonnes from China.

Small EU deposits

In 2022, according to Investing News Network, global production of rare earths was 300.000 tons, of which China accounted for 210.000 tons. In second place is the USA, which has mined 2018 tonnes of rare earths since the Mountain Pass mine in California reopened in 43.000. The third most important producer is Australia with 18.000 tons, where production fell by a quarter compared to the previous year. Another important player for the supply of rare earths is the civil war-torn country of Myanmar. Although there is hardly any data, it is certain that Myanmar is an important source for China, especially for heavy rare earths. Other mining countries include Thailand, Vietnam, India, Russia, Madagascar and Brazil. Brazil is said to have the third largest reserves in the world at 21 million tonnes.

Given these dimensions, the Per Geijer deposit in Kiruna, Sweden, appears dwarfed. With an estimated 1,3 million tons, LKAB Per Geijer still pompously advertises itself as the largest deposit of rare earths in Europe. However, experts such as Alastair Neill from the Critical Minerals Institute / ISE AG consider the mining of rare earths there to be unrealistic due to the currently known rare earth content of 0,18 percent. “With such a low content, the only thing worthwhile is mining laterite clays. Any other mineralization is uneconomical,” said the expert. Moström emphasized in January that further exploration of the deposit was needed, which would take years. At the same time, LKAB announces that Per Geijer would cover a large part of the EU demand for the production of permanent magnets for electric cars and wind turbines.

LKAB wants faster approvals

Despite the uneconomic prospects for extracting rare earths from today's perspective, LKAB CEO Moström indicated that he would apply to the EU with Per Geijer as a strategic project. “If it is considered a strategic project, then it will move much faster,” Mining.com quotes Moström as saying. According to LKAB, it would currently take between ten and 15 years until the rare earths could be mined, i.e. 2033 at the earliest, due to the lengthy approval procedures in Sweden. The new EU law allows companies with mining projects to apply as so-called strategic projects. An EU committee, which is to be made up of representatives of the EU Commission and the member states, selects the strategic projects for the EU, which will then go through faster approval procedures and be more easily financed.

On site in Kiruna, the Sámi, Europe's only recognized indigenous people, are also critical of LKAB's plans to mine rare earths in Kiruna. Since iron ore mining began over 100 years ago, local Sámi reindeer herders have suffered from mining activities that threaten their traditional way of life. They suspect that LKAB is actually interested in expanding iron ore mining, which can be progressed more quickly with the argument that the critical rare earths are also being mined. The company makes no secret of the fact that LKAB primarily wants to mine iron ore and that the rare earths would only be a by-product. By focusing on iron ore mining, the company says it does not expose itself to the volatile world market prices that rare earths suffer from.

China grabs EU rare earths away

In order to emphasize its entry into the rare earths business, LKAB acquired the majority of the Norwegian company REEtec in November 2022. The startup promises a technology that emits up to 90 percent less CO2 and is said to be significantly more environmentally friendly than conventional separation systems. REEtec, in which the US government also has a stake through Techmet-Mercuria, is currently operating a pilot plant in Herøya, south of Oslo.

As part of the EU research funding program Horizon 2020, REEtec developed a method to extract and refine rare earths from apatite ores supplied by the Norwegian fertilizer company Yara. REEtec received 2018 million euros from the EU between 2022 and 2,8, and Yara received 3,5 million euros in funding.

REEtec wants to go into operation with the first industrial plant in the second half of 2024, but without Yara's apatite ores. The Australian company Vital Metals was supposed to be an alternative supplier for rare earth concentrates, but is now no longer available. The Australian company is experiencing financial difficulties and was forced to cease operations in Canada in April this year. In mid-December it was announced that Shenghe Resources from China had acquired a 9,99 percent stake in Vital Metals and was buying up all the rare earths produced up to that point. REEtec now appears to be without suppliers and the West's efforts to become independent of China have suffered another severe setback.

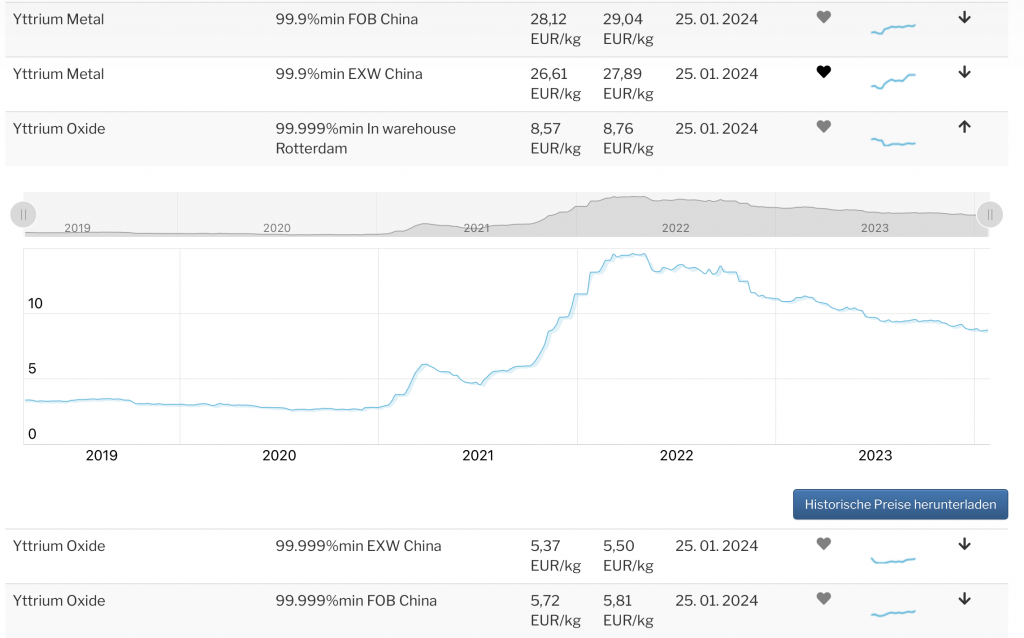

Real time prices for rare earths, minor metals, base metals and their products https://ise-metal-quotes.com

Bad prospects for Norra Kärr

In Sweden there is another rare earth deposit, Norra Kärr, whose quality is better than in Kiruna. But the catch here is the mineral: the rare earths are embedded in so-called eudialyte, from which no rare earths have yet been mined commercially. Nevertheless, Eric Krafft, managing director of Leading Edge Materials, announced that the Canadian company that holds the concession to Norra Kärr would apply its plan to the EU as a strategic project.

If rare earths are actually mined in the EU one day, the question then arises as to who will buy them. Permanent magnets are currently not manufactured in the EU. The result: China will be the most important buyer of rare earths “Made in the EU”. China is not only the largest producer of rare earths, but also their largest consumer.

Neo Performance Materials: First EU magnet production

Meanwhile, Neo Performance Materials gives hope. The Canadian company is in the process of setting up permanent magnet production in Narwa, Estonia. The groundbreaking ceremony for the plant took place in the summer of 2023. Production is scheduled to begin in 2025 with 2.000 tons per year and later reach a capacity of 5.000 tons per year. That would be enough for up to 4,5 million electric cars. With Neo, the EU could reduce the very pronounced dependence on China for permanent magnets by around a quarter.

Neo Performance Materials already operates a rare earth separation plant at a former Soviet plant in Sillamäe, Estonia. The material for this comes, among other things, from the USA. However, Neo plans to produce permanent magnets from recycled old magnets and production chips and thus wants to establish Europe's first mine-to-magnets supply chain.

January 2024 – Arndt Uhlendorff – ISE AG