Auto industry biggest driver for cobalt mining

Persistently miserable mining conditions in the Democratic Republic of the Congo cast a shadow over the otherwise clean image of electromobility.

Even if there are now alternatives, cobalt will remain indispensable for electric cars in the medium term. Despite price volatility and sometimes inhumane working conditions, global mining increased to 2021 tons in 175.000, according to The Cobalt Institute. This corresponds to an increase of 21 percent compared to the previous year. Cobalt production is thus continuing to pick up speed: between 2015 and 2020 the annual growth rate was half as strong at nine percent.

Three quarters of the world's cobalt is mined in the Democratic Republic of Congo (DR Congo) as a by-product of copper mining. In 2021, this corresponded to almost 118.000 tons. Other mining countries are Australia with 5.600 tons (3 percent), Cuba and the Philippines, Russcountry, Kswim und Papua New Guinea, which have each produced 3.000 to 5.000 tons of cobalt. The growing demand is due to the battery industry, which claims two-thirds of the metal.

Auto industry overtakes electronics industry

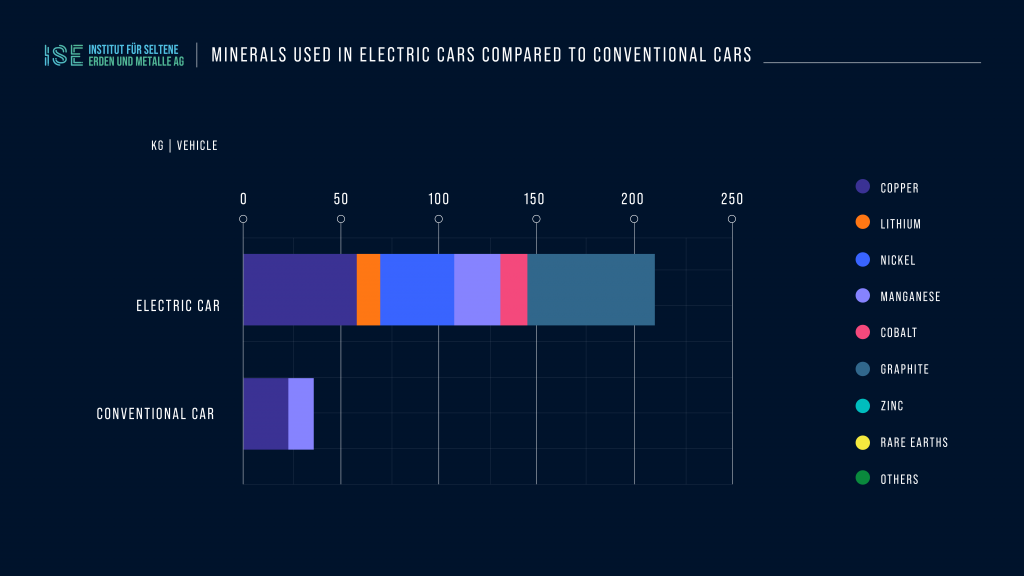

Until recently, the electronics industry dominated the demand for cobalt. 2021 advanced However, the automotive industry became the most important sector for the rare metal for the first time with a share of 34 percent - this is accompanied by the doubling of e-car sales compared to the previous year. The trend is still rising, because the electric car market also has the greatest growth potential. A fully electric vehicle contains 4,5 to 15 kilograms of cobalt. A fraction of this amount is used in smartphones, which weigh between five and 20 grams depending on the model.

Car manufacturers are working hard to reduce the amount of cobalt. So far, the cobalt content in e-cars has been reduced by a third to less than ten percent. Despite these advances, cobalt demand will multiply by 2030. This is due to the increasing demand for e-cars and the trend towards larger batteries. In 2022, over 10 million new e-cars were sold. The International Energy Agency expects 2030 to 25 million new electric vehicles (including plug-in hybrids) in 45.

The use of cobalt is due to political instabilityt in DR Congo not only a high cost factor, but is also criticized from an ethical point of view. Violations of human rights, child labour, environmental degradation and corruption are at odds with the clean image of electric mobility, which is now definitely the main driver of cobalt mining in the unstable country.

The so-called is particularly problematic artisanal mining in DR Congo, which is unregulated and particularly dangerous for workers. Historically, this form of mining has been in decline, but it is regaining importance due to increased demand and, depending on the source, accounted for between 2021 and 30 percent of total production in the Central African country in XNUMX. Thus, just as much or more cobalt comes from Congolese artisanal mining than from the three producing countries Australia, Russia and Cuba combined. Well over half of the world's reserves are in DR Congo, making the country central to meeting demand for the foreseeable future.

Automakers are working on supply chain transparency

Car manufacturers, battery producers and the electronics industry are trying to improve the situation in DR Congo. BMW, Volkswagen, BASF and Samsung are part of the cross-industry project "Cobalt for Development" carried out by the German Society for International Cooperation (GIZ). Among other things, training courses are intended to improve the working and living conditions of prospectors in small-scale mining.

The Volkswagen Group and Mercedes also want to ensure more transparency in their supply chains through a partnership with the agency RCS Global, which specializes in supply chain analysis. BMW tries to source cobalt outside of Central Africa. For its fifth generation of high-voltage batteries, which are used in the iX3 model, the Bavarian car manufacturer purchases cobalt directly from raw material producers in Morocco and Australia and then provides it battery cellsmanufacturers available.

In addition, BMW wants to significantly increase the proportion of recycled cobalt in the future and is working together with the Belgian metal and recycling company Umicore. Volkswagen also operates a pilot plant in Salzgitter in which used electric car batteries are recycled. Theoretically, cobalt and nickel can be almost completely recycled. Das Öko institute calculated that by 2030, just 2050 percent of cobalt demand will come from recycled products. In 40, cobalt recycling could even account for XNUMX percent.

Mercedes deliberately decided not to generally exclude critical countries of origin such as the DR Congo as a source of supply and, according to its own statements, is following recommendations from NGOs and politicians. The strategy: through höhere requirements establish compliance with human rights locally and promote the local economy. In the future, Mercedes only wants to purchase battery cells with cobalt from certified mining. But the reality is complicated.

Mining conditions remain miserable

Despite the commitments and numerous initiatives, the situation in DR Congo remains very unsatisfactory. The US author Siddharth Kara is harsh on the electric car manufacturers. "What is being done is far from enough." During his research in the DR Congo, the expert specializing in modern slavery was able to penetrate mining sites that are difficult to access and which officially should not even exist. These are pits that belong to the big mining companies and in which, according to Congolese legislation, artisanal mining is not allowed to take place.

However, in a video Kara shared on social media, that's what appears to be happening. You can see a seemingly endless crowd of people in a huge pit, the Shabara mine, which according to AFP belongs to Glencore. Thousands of miners without protective clothing break stones or fill sacks with the blue-speckled ore with their bare hands. Kara has summarized his research in the recently published book "Cobalt Red" and hopes that those at the other end of the supply chain will find the lives of the Congolese worth enough to to work towards serious improvement.

dead end corruption

Other voices, however, see the Congolese government's failure in the fight against the inhumane mining conditions. Corruption extends to the highest levels of government. "Many reforms have been thwarted because there are certain interests in maintaining the status quo," says Sasha Lezhnev from the NGO The Sentry of the AFP news agency. Mine operator Glencore has been trying for years to put an end to illegal mining on its concession. “Up to 40 trucks leave the site to deliver to other companies. It is evident that this is organized and not the work of artisanal miners," a Glencore spokeswoman quoted AFP as saying.

In recent years, Chinese mining companies have greatly expanded their presence in Central Africa. They ship the cobalt precursors to China, where they are used to produce high-purity cobalt chemicals for the battery industry. China is by far the most important producer of lithium-ion batteries. According to that Observatory of Economic Complexity (OEC) China nearly tripled cobalt imports from DR Congo between 2015 and 2020. However, the largest single cobalt producer is the British-Swiss mining company Glencore, which also mines cobalt in Australia and Canada. Glencore operates a nickel and cobalt refinery in Norway.

Cobalt-free electric cars on the rise

The question arises as to whether the automotive industry, as the most important customer, can do without cobalt? The metal is an important component in the cathodes of lithium-ion batteries because it ensures higher energy density, which in turn is relevant to the vehicle's range. In electric cars, lithium-ion batteries with nickel, manganese and Cobalt (NMC).

However, cobalt-free electric cars are already a reality, especially in China. Many car manufacturers there have been using lithium iron phosphate (LFP) batteries for a long time. These are much cheaper because they do not contain cobalt and nickel, the most expensive elements in an electric vehicle. They also have a longer service life and are also said to be safer in terms of fire hazard.

The losses in range are becoming smaller and smaller as a result of ongoing optimization. Tesla is one of the first Western manufacturers to rely on LFP batteries from the Chinese battery manufacturer CATL and install them in the Model Y and Model 3. CATL was able to further increase the energy density of its LFP batteries. According to CEO Elon Musk, the range difference to the model 3 with the NMC battery is only 16 kilometers. Almost every second vehicle that comes off the assembly line at the US manufacturer is said to be equipped with an LFP battery. Musk announced that all standard-range electric cars will use this battery technologyumdeliver.

CATL also announced last year that Lithium Manganese Iron Phosphate Batheriasn to mass production. Their energy density is up to a fifth higher than that of LFP batteries. German automotive groups have also jumped on the LFP bandwagon and have already announced LFP batteries for certain models. The industry is already talking about a new "Iron Age".

But even if the auto industry does away with cobalt altogether in the future, there will still be electronics and other industries that need cobalt. Because of its heat resistance, the metal is used in the ceramics and aerospace industries. In 2021, these branches consumed a total of 117.250 tons, or two-thirds of global production. This corresponds exactly to the production volume from the DR Congo. The country and its population will continue to make an important contribution to our high-tech everyday life.

Sources are available upon request.

Institute for Rare Earths and Metals AG - ISE AG - Arndt Uhlendorff - February 2023