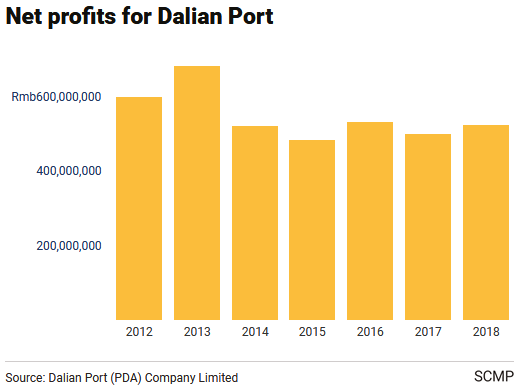

Dalian Port's earnings have dropped more than 2013 percent, according to the 2018 30 group's financial results. Photo: Xinhua

- The region around the Rust Belt is focused on attracting more companies from Japan and South Korea to use the subsidized Sea-to-Rail service, a signature of the Belt and Road Initiative

- Liaoning, the US's fourth largest export market, plans to connect to Russia, Eastern Europe and Central Asia via the Dalian port

Ports in northeast China's Liaoning Province have for some time relied on the success of the Beijing Belt and Road Initiative, a global trade strategy that connects China with growing consumer classes in Asia, the Middle East and Europe.

So far, however, the plan has not proved to be the hoped-for wayfinder, as many large ports in China are competing for parts of the maritime-to-rail traffic created by the trade initiative and subsidizing trade. Government offers to support it. In addition, slower growth in world trade due to the US trade wars, overcapacities in ports and a decline in foreign investment have put pressure on their business.

For the Port of Dalian, through which most of Liaoning's foreign trade flows, the Belt and Road Strategy shows that government planning has played an important role - both positive and negative - in opening up new markets and businesses in the weak To advance rust belt. It is this preponderance of government presence in industries and corporations that has become one of the most controversial issues in the trade negotiations between China and the US.

The ongoing trade war with no signs of a short-term solution will further dampen overall container traffic growth in China, which has the busiest container shipping ports in the world. According to a report by US rating agency Moody's released in May, the growth rate is likely to fall to zero or a low single-digit percentage over the next 12 to 18 months.

The last round of talks ended on Wednesday with little progress. Photo: Reuters

The government has pushed for further consolidation of Liaoning ports to enhance their performance, but also to strengthen state control in this sector. In June, the state-owned China Merchants Port Holdings increased its stake in Liaoning Port Group, which controls three northeastern ports including Dalian, to 51 percent, thereby giving it majority control.

In Liaoning, the US is one of the fourth largest export markets. Dalian, the province's largest port, is home to a range of US imports, including agricultural products, automobiles and car parts, as well as technology products such as LED displays and integrated circuits, some of which are trade tariffs.

To improve its business assets, Dalian is focusing on leveraging its position as one of the major Chinese ports near Japan and South Korea to connect its shipments with Russia, Eastern Europe and Central Asia via sea-rail freight.

A typical route starts in Japan or South Korea. Ships stop in Dalian where goods are unloaded and transhipped onto Chinese-European trains to markets in Manzhouli, Irkutsk, New Siberia or Moscow.

According to Xia Ting, a manager at Liaoning Port, the sea-to-rail service could reduce the delivery time from Dalian Port to Moscow to just 12 days, a quarter of the 50 days for shipping goods by sea to northern European ports needed to be a spokesman for the Dalian container development.

On paper, this is a gain for the Liaoning ports as they expand their business and reduce dependence on US trade. So far this has not worked. Japanese and South Korean companies, the major suppliers of electronic goods, equipment, cars and car parts to Europe and China, have rarely taken sea-to-rail freight.

In addition, the operation requires significant subsidies from local authorities in the region, many of which are already burdened by declining revenues and high debts.

According to a research report by the Institute of Geographic Sciences and Natural Resources in December, a think-tank sponsored by the Chinese Academy of Social Sciences in Beijing, nearly all services to Europe have been subsidized by the local government.

The subsidies varied between 2.000 and 3.000 US dollars for every two 20 foot containers (TEU), some of which amounted to as much as 7.500 US dollars if the goods were manufactured locally.

" From now on ... it is permissible to promote the development of trains in China through subsidies in the initial phase as a guide to policy or market maintenance. However, it is ultimately not sustainable, "says the report.

From now on ... it is permissible to promote the development of trains in China through subsidies in the initial phase as a guide to policy or market maintenance. However, it is ultimately not sustainable, "says the report.

The difficulties in maintaining these operations are already evident in Dalian. Without a steady supply of goods by sea, traffic from the estimated 35.000 TEU goods shipped at peak times during the 2016 and 2017 years has slowed significantly, Xia said, without giving comparative figures.

According to the Ministry of Commerce, in 2018, a total of 6.300 freight trains sailed between China's ports and Europe, which is estimated to be around 600.000 TEU goods shipping. However, compared to the total of 42 million TEU goods shipped through Shanghai's largest Chinese port last year, these figures have fallen.

Since 2018, the old coastal ports of Shanghai and Xiamen and heavyweights in the interior like Chongqing in the southwest and Xian in the west are fighting for pieces of the same cake.

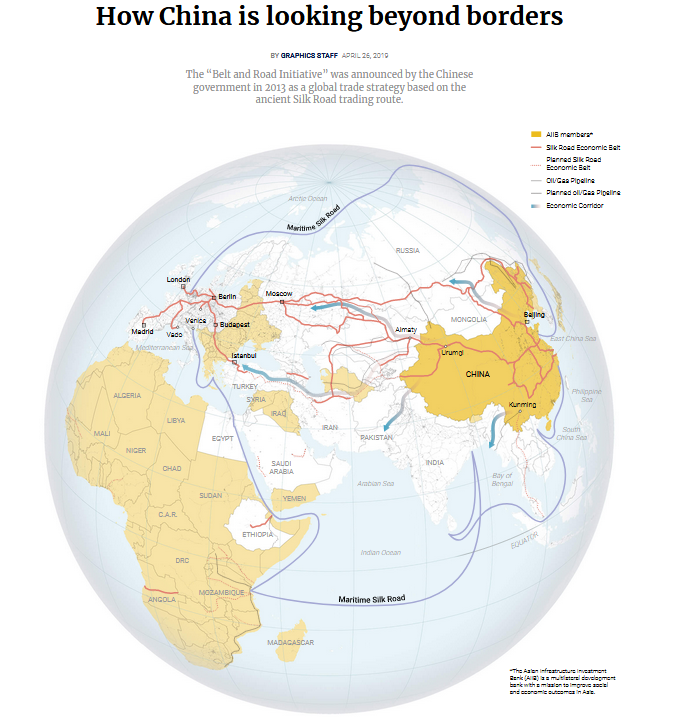

The Belt and Road Strategy, the cornerstone of President Xi Jinping's foreign policy, aims to build infrastructure projects to connect Asia with Africa and Europe, thereby boosting trade.

However, the strategy has been criticized by China's largest trading partners, complaining that the country's state-owned enterprises have an unfair advantage over foreign players.

China's state-dominated port and shipping sector was an integral part of the Belt and Road Initiative and would benefit most from increased global trade. However, that was not the case for the northeastern rust belt - Liaoning, Jilin and Heilongjiang provinces - where profits have declined, their traditional heavy industries such as shipbuilding, steelmaking and coal mining have declined in sales over the years.

In Liaoning, the largest economy in the region, which has also been declining economically since 2014, investments from Japan and South Korea have not yet arrived.

Graphic: South China Morning Post

According to government statistics, foreign direct investment in Liaoning decreased from 27,42 billion dollars in 2014 by more than 80 percent to 4,9 billion dollars in 2018 year, largely due to cuts by Japanese and South Korean companies. There are indications that foreign investment is stabilizing at a low level, while the provincial government has intensified its efforts to improve relations with Japan and South Korea in support of the Belt and Road Plan.

"The routes are not yet efficient and prices are reasonable for foreign companies investing and building here," said Yuan Zhenhe, deputy general manager of Liaoning Shenha Hongyun Logistics Company, the sea rail business platform for the Yingkou -Port, the second port controlled by the Liaoning Port Group.

"At the moment the competition is tough and to my knowledge there are 29 cities across China offering sea freight services. Foreign companies will therefore first carefully review local policies and costs before deciding where to spend their money. "

Exports of Dalian's automotive and automotive industries, through a joint venture with Dongfeng Motor Cherry automobiles and Nissan automobiles of the local brand, have collapsed due to political uncertainties in the emerging economies to which they are delivered.

He said that in 2006, the car terminal handled more than 2.000 used cars by sea-to-rail from Japan and South Korea to Kazakhstan. However, this business was not consistent due to a lack of merchandise.

"In the year 2006 without the belt and road concept ... it was based solely on the market requirements," said Ding.

"Now we see companies that deal with it. We prepare for it. We cooperate with Japanese and Korean companies. "

Source and Images: South China Morning Post