Blockchain technology - the future is already today

In the past five years, the blockchain has become as popular as the internet. Blythe Masters, CEO of Digital Asset Holdings, said, “Blockchain technology should be taken just as seriously as the development of the Internet in the early XNUMXs. It's like an email to send money ”.

The world is entering an era without intermediaries. The predictions made by the World Economic Forum in Davos last year could support the blockchain revolution. According to this, 2027% of total global GDP will be stored in blockchain networks by 10. But even now everyone on earth with internet access can use blockchain mechanisms.

Smart contracts - who needs it?

Everyone who is interested in a secure and fast exchange of information without intermediaries, as well as everyone who needs openness paired with security. The technology offers one hundred percent information transparency, processing stability, a new level of data protection and lower costs for account and transaction services. Incidentally, the advocates of the technology promise that international payments by small and medium-sized companies and private individuals can only be processed via the blockchain as the accessibility of blockchain instruments increases, which will be much faster and cheaper. In addition, the technology will avoid numerous transaction processing errors and reduce the number of fraudulent transactions.

The technology has become most widespread in the financial sector. Today, 11 banks, including Bangkok Bank, BBVA, BNP Paribas, HSBC, ING, Intesa Sanpaolo, Mizuho, RBS, Scotiabank, SEB and US Bank, are developing a blockchain platform for trading operations (currently 90% based on paper documents).

Central bank digital currency (CBDC) has become a hot topic in the financial world recently. Several central banks are conducting analyzes and studies in which they examine the technical and economic feasibility of introducing digital money and the possible effects on monetary policy, liquidity, etc.

Further crypto signals are currently coming from Amazon, in the form of a new job advertisement on the business platform LinkedIn. The subsidiary Amazon Web Services (AWS) would like to accelerate the processes in the processing of cryptocurrencies such as stablecoins, security tokens or non-fungible tokens. To this end, specialists are needed for processing transactions and storing digital assets in the cloud.

Our institute follows technological developments and has already supported a number of projects for the development and creation of blockchain-based cryptocurrencies, namely stablecoins. During this time, important aspects have been identified that must be taken into account when deciding whether to purchase them. Another area is smart contracts, which we see as a new service for fast transactions, audits and money transfers.

Cryptocurrencies have developed into a new asset class!

A turning point is looming in the cryptocurrency business. After the Sturm und Drang years with enormous price fluctuations, in which private investors in particular traded on unregulated online marketplaces, an era of professionalization begins. Institutional investors are pushing the further development of Bitcoin, Ethereum and Co. into an independent asset class.

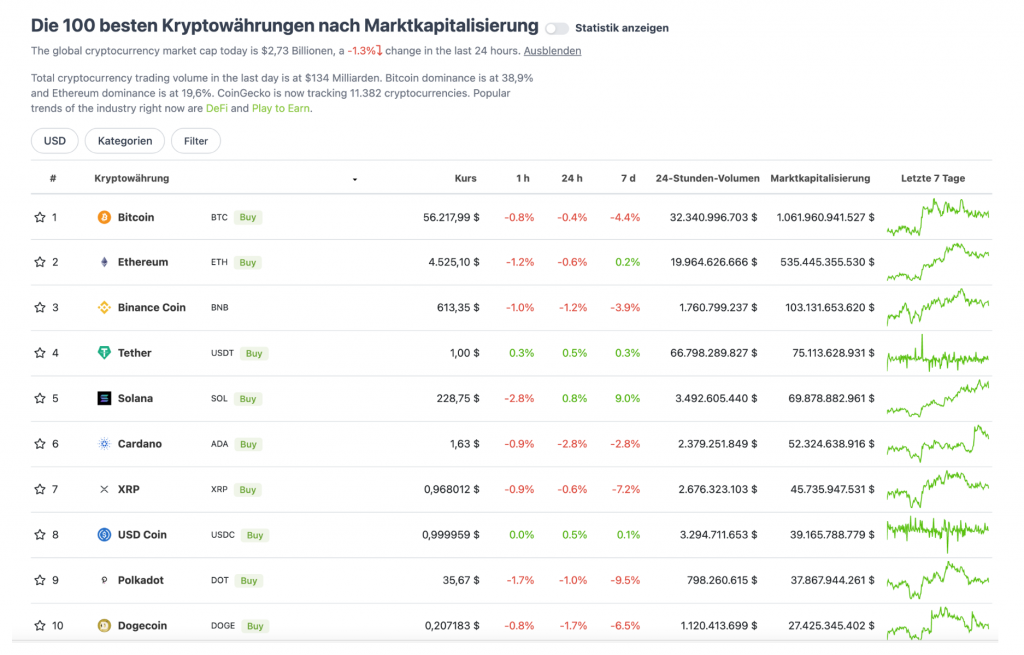

The speed with which this change is taking place is exorbitantly high. The capitalization of the cryptocurrency market, the entire history of which is only a little over 10 years old, has roughly quadrupled since the beginning of the year, reaching $ 2,73 trillion (data from CoinGecko dated 03.12.2021/XNUMX/XNUMX)

This is supported by the growing popularity of leading cryptocurrencies like Bitcoin, as well as the influx of institutional investors into the market, which helps reduce volatility. This has been a major factor in the past that has discouraged conservative gamblers.

To reduce volatility, a "stable currency", i.e. stablecoin, was created. This has helped stabilize the prices of digital assets.

Stablecoin refers to a cryptocurrency asset whose current value is secured by one of the traditional and liquid asset types - currency, commodities, metals - that is, assets that are accepted in global financial practice as a reliable and legitimate means of settlement. The main goal of stablecoin is to smooth the volatility of the cryptocurrency, as its price (exchange value on the market) is “tied” to the price of, for example, the US dollar, the Swiss franc, gold or other metals. There is an analogy here to the events before 1973, when the US dollar was completely backed by gold, the so-called "gold standard". The advantages of such practices are as follows: predictable cryptocurrency prices, which make it possible to process long-term contracts between counterparties; insurance against the strong devaluation of cryptocurrencies, especially if information manipulation technologies are used by insiders; and the ability to use asset-backed cryptocurrencies as a means of accumulation and reservation.

Advantages of stablecoins

The advantages of metal-backed stablecoins enable transactions in which participants can sell excess quantities of a particular metal to third parties on more favorable terms than with conventional contracts. Stablecoin also significantly lowers transaction costs and enables customers to trade faster.

- The ability to invest in metals without the hassle of transporting and storing them

- By purchasing stablecoin, the user can either resell it and exchange it for physical metal.

- Accessibility not only for institutional investors but also for private investors

Disadvantages of stablecoins

- There is one major disadvantage with all metal-backed stablecoins. The percentage of their security and liquidity depends on who issued them.

- That is why strict controls are important here. Otherwise, it will be impossible to ensure the security and connectivity between the metals and the stablecoins. A 1: 1 ratio can only be achieved if it is centralized.

- The audit is part of the control system. It helps to ensure all special functions. Slow withdrawal of funds.

The Institute for Rare Earths and Metals (ISE) on the subject

In this case, our institute offers its services for the audit and verification: confirmation of the quantity and quality of the goods as well as their evaluation. It is important to take into account the international standards that state that an audit should be carried out every quarter to ensure transparency and credibility of the company. It is important to recognize that overall liquidity is affected by changes in metal prices and increases or decreases in sales. All of these measures should be strictly regulated.

A stable coin is a regulated financial instrument, so a stable coin always has a sales prospectus, similar to stocks or funds. We have observed that there are currently many utility coins that present themselves to the outside world as securitization of values. As a rule, an attempt at fraud can always be assumed here, since this is definitely a financial instrument that is subject to regulation.

We have also found that there are coins or tokens that have been rated for 5 years or even older. If a price was determined for a commodity five years ago, it usually has nothing in common with the current price today.

There are metal products that have a very high price in their valuation for their smallest unit (1 gram, 1 meter, etc.). All metal products are synthetically produced goods which, like all synthetic goods, decrease in price as the quantity increases. We have observed that, for example, the price of one gram of copper powder (EURO 1200-1800) in quality 99,9997%, spherical and smaller than 10 µm is extrapolated linearly to several hundred kilograms. This is a milkmaid bill and in no way corresponds to the reality. The price per unit of all manufactured goods decreases as the quantity increases. The narrower a market, the more drastic the discount.

In addition to some stable coin projects, the ISE also supports its own project in the field of smart contracts. A smart contract based on a self-written blockchain is currently being tested to facilitate the purchase and sale of metals from May 2022. We will report more on this topic shortly. Please send press inquiries to [email protected]

Examples of stablecoins

- Digix Gold (DGX) is an ERC-20 token based on Ethereum. It is backed by gold: 1 DGX corresponds to 1 gram of the metal. Your gold reserves are stored in Singapore and are checked every 3 months. DGX owners can even exchange the currency for real gold bars - but a trip to Singapore is required.

- Tiberius Coin (TCX) is not tied to a single asset, but rather a combination of 7 precious metals used in the manufacture of high-tech devices. The value of TCX is expected to increase as solar cells and electric cars become more widespread.

- SwissRealCoin (SRC) is backed by a portfolio of real estate in Switzerland. Stablecoin holders can vote to select properties for investment.

The scenarios for the possible use of the blockchain are very diverse. Companies see potential uses for distributed registers in the areas of land registry, voting, product distribution, energy, crowdfunding, auditing and notary services.

A global open source community, Hyperledger, is currently working on cross-industry blockchain scenarios. SAP Ariba works with the global Everledger network to track the production and delivery of goods - from raw materials to sales.

One can have different views on cryptocurrencies, and it doesn't matter whether blockchain is revolutionary or not, as there is no doubt that it will have a significant impact on a number of traditional industries as technology drives the creation of new businesses, products , Services and applications. What's more, all of this is already happening. And this step towards the "mass" use of the blockchain marks the end of the first phase of the development of this technology.

There is currently no legal regulation of cryptocurrencies, but as soon as there is an effective regulatory system (which regulators around the world are actively striving for), there will only be "reputable" cryptocurrencies that really have value and for which there are long-term prospects and will give new development opportunities. There will be a predictable version of the crypto market where cryptocurrencies will become a trustworthy asset class.

ISE - December 2021