The price and popularity of cobalt (also: cobalt), a rare, hard metal element, has increased in recent years. Metal has become one of the most important components in a wide range of applications, from magnets to paints, to chemical catalysts. In recent years, demand for the metal has risen sharply due to its crucial role in batteries for electric appliances and electric cars. Almost half of the cobalt produced is used for battery chemicals. Almost one-fifth is processed into superalloys used in high-end products such as aircraft engines.

We'll take a closer look at the global cobalt market and show you which ten cobalt stocks should be included in each investor's portfolio.

Privately organized cobalt mining in the Congo. 90% of the raw material will be mined by the Ruashi mine in south-eastern Congo.

Cobalt producers: The Democratic Republic of the Congo and China dominate

Cobalt is very rare and the most common occurrence is in a highly unstable country in the heart of Africa, the Democratic Republic of the Congo (DRC). Over half of the world's deposits of nearly seven million tonnes of cobalt are in the Democratic Republic of the Congo. Nearly two-thirds of global production comes from the country. No other country in the world approaches the DRC cobalt concentration: Cuba, Russia, Australia and the Philippines are other important cobalt producers. But none of these countries produces more than 5% of world production.

The Democratic Republic of Congo has historically been a very unstable country plagued by corruption and war. His oversized role in the worldwide cobalt market is far from the ideals of those who would like to degrade the metal. The political environment can be very volatile, the supply is quickly endangered and mine operators are often faced with security problems.

While Rohkobalt is the dominant theme in the DRC, at the other end of the market segment another country has emerged to dominate the market. According to estimates, China refines more than half of the world's cobalt production. Cobalt 27 Capital, which is investing in metals needed to build electric vehicles, warned earlier this year that "Cobalt's two main problems with the supply chain are concentrated production and reserves in the DRC and Chinese control over the majority of refined cobalt production ".

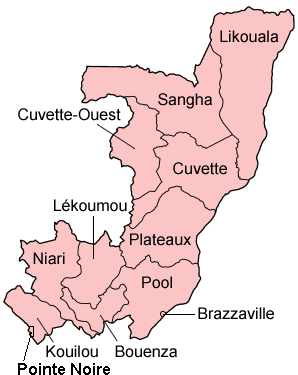

The classification Congo

Cobalt: a rare but important metal for the modern world

Although cobalt has become one of the most important components in many industries thanks to its unique properties, the instability, volatility and uncertainty of metal supply has led many companies to take drastic steps to meet their demand for cobalt. Or they try to do without the metal right away. Tesla and other automakers are trying to reduce the amount of cobalt needed to build their batteries. Apple, a technology giant, has reportedly cut cobalt supply contracts with mine operators to gain more control over its supply chains. For the production of an EV, between 4 and 14 kg of cobalt (for a plug-in hybrid 1 to 4 kg) is required. An average smartphone needs 5 to 20 grams (tablets and laptops need a lot more with 20 to 50 grams).

SK Innovation and LG Chem have announced that by the end of the year they will be making new batteries that use more nickel (more common) than cobalt. Currently, batteries contain almost 20% cobalt. The new batteries of South Korean companies only contain 10%. Efforts to reduce the amount of cobalt aim to reduce costs, but also to improve the energy density, which has become a major obstacle for electric car makers to shorten charging times and extend range - and at the same time Cost cutting.

However, doubts arise as to whether the demand for cobalt can be completely reduced. According to the Belgian materials technology and recycling company Umicore, it is possible to reduce the amount of cobalt needed in the batteries, but a complete abandonment is not in sight in the near future.

"Cobalt is the element that compensates for the lack of stability of nickel. There is no better metal than nickel to increase the energy density and there is no better metal than cobalt to provide the necessary stability. A complete abandonment of cobalt is not possible in the next three decades. It just does not work, "says Marc Grynberg, Chief Executive Officer of Umicore, earlier this year.

This opinion is synonymous with Sherritt International. Thus, "cobalt in the near future will be indispensable for the production of batteries for electric vehicles".

Where is the price of cobalt going?

In the first half of 2018, prices for Kobalt recovered, reaching a new high of $ 44 per pound in June. However, prices fell sharply in the second half of the year and started the year 2019 at about 25 $. At Glencore, this development was described as "two halves," as the US-China trade war and the sustainability of Chinese growth weighed on prices. Despite the dramatic drop in prices since its high, the year-end price of cobalt was more than 30% higher than 2017's year-end price.

Since the 4. On April 2019, Cobalt is trading closer to the 14,50 $ mark, after the price has plummeted since the beginning of the year. The trend was in line with market requirements. In its annual report, China Molybdenum warned of a decline in cobalt prices in the first half of the year, as 2019's supply of metals and upstream cobalt products exceeds demand. In addition, forecasts by the metalworking company CRU see little supply overhang over the next few years before supply bottlenecks due to increased demand for electric vehicles. According to China Molybdenum, "cobalt price price forecasts are going to be between 20 and 30 $" per pound in the future, suggesting that the price may well be up at its current low level.

Ten promising cobalt stocks to keep an eye on

Here are the ten cobalt stocks that investors should keep in mind:

- Glencore

- China Molybdenum

- OK

- Umicore

- Sherritt International

- Cobalt 27 Capital

- Wheaton Precious Metals

- African Battery Metals

- Red Rock Resources

- Horizons Minerals

In the context of cobalt, it is important to note that 99% of cobalt is degraded as a by-product of other metals. About two-thirds of cobalt is extracted from copper, the remainder from nickel mining. This is significant in that it is highly unlikely that manufacturers would have to stop production if, for whatever reason, the demand for cobalt suddenly collapsed as long as the demand for the primary product remains. Instead, it would rather mean that their copper or nickel mining has become less profitable. The demand for cobalt can make a big difference in balancing the pros and cons of a copper or nickel mine.

To benefit from the developments around Kobalt, investors must therefore invest in companies that generate the majority of their revenues from other metals. Cobalt is rather irrelevant to increasing revenue among the biggest producers. Most "pure plays" are exploration and development companies that have yet to achieve their business success. However, investors can directly benefit by investing in companies that provide investment or financing opportunities for cobalt producers and developers, and in return receive licenses or a piece of the pie.

Glencore: The world's largest cobalt producer

Glencore is the world's largest single producer of cobalt. The metal is mined mainly as a by-product in the copper mines Katanga and Mutanda in the DRC. The company also mines nickel in Australia (Murrin Murrin), Canada (Raglan and Sudbury) and Norway (Nikkelverk).

Glencore's cobalt production increased 2018 by 54% to 42 200 tonnes. The increase in production was mainly due to Katanga Mine, but sales did not perform well. The production had to be stored because the uranium content was too high and must be reduced to zero before the sale.

Glencore is the largest foreign company in the DRC and has been able to prevail in recent years against the difficulties encountered in the country. Last year, the company had to comply with a new mining law and tackle some legal struggles with the state mining company of the Congo, Gecamines, regarding property rights. In addition, it had to pay Dan Gertler to avoid a loss of control over the assets. However, this was made more difficult by US sanctions on the Israeli businessman.

In February, a South African statement by Albery Yuma, CEO of Gecamines, highlighted the tensions between government and industry. "I find it scandalous that in the discussion about cobalt and the increasing number of electric vehicles only the dealers and consumers have their say and not the Congo and Gecamines," he said.

Glencore remains optimistic about Metall and wants to more than double cobalt production compared to the other metals in the company's portfolio between 2018 and 2021. The production was steadily increased compared to 2013 last year with only 19 000 tons. Forecasts predict 2019 production volumes from 52 000 to 62 000 tons and 2020 56 to 000 70 tons and 000 2021 61 to 000 75 tons. Glencore aims to increase production by 000% over the next three years as a mean of these production margins.

Although cobalt only contributes a small part of Glencore's overall business, a good or bad year for the metal can make all the difference. For the year 2019, price changes of $ 1 per pound of cobalt will affect earnings before interest, taxes, depreciation and amortization (EBITDA) of $ 100 million.

China Molybdenum: double access to cobalt from the DRC and Chinese metallurgical plants

China Molybdenum is the second largest cobalt producer. The cobalt is mined in the Tenke Fungurume Mining project (owned by 56%), which is located in the same region in the DRC as Glencore's Katanga Mine. In addition to molybdenum, tungsten, copper and phosphorus-containing minerals, the company's portfolio also includes niobium, which has the second largest share in the company's production.

Coal mining in the DRC reached its peak in 2018 following an increase of 14% on 18 747 tons. Remarkably, cobalt sales increased at 27% much faster because the company sold some of its inventory. The lower inventory of cobalt comes at a time when the company has lowered the production forecast for 2019 down to 16 500 to 19 000 tons.

China Molybdenum can be a unique proposition for investors as it has access to raw material in the Democratic Republic of the Congo as well as to the refined product concentrated in China. However, this also means that the price of its product has been affected by the sharp increase in smelting capacity in China last year and the subsequent oversupply of cobalt concentrates and intermediates.

Vale: Big with cobalt on nickel

Brazilian mining company Vale generates less than 1% of its total sales of cobalt (313 million $ 2018), but the metal has sparked corporate interest. Just recently, it has completed a deal whereby 75% of future cobalt production from its Voisey's Bay Mine in Canada will be sold to two companies: Cobalt 27 Capital and Wheaton Precious Metals.

Brazilian mining company Vale generates less than 1% of its total sales of cobalt (313 million $ 2018), but the metal has sparked corporate interest. Just recently, it has completed a deal whereby 75% of future cobalt production from its Voisey's Bay Mine in Canada will be sold to two companies: Cobalt 27 Capital and Wheaton Precious Metals.

For Vale, the logic behind the deal is to immediately sell the future production for cash, which in turn will expand the underground mine. This means that the company can reduce its current development costs. At the same time it retains some of the benefits of any cobalt produced - and all of the nickel. Wheaton has paid its purchase price of 390 million $ cash; Cobalt 27 has paid 300 millions of dollars. The sum of 690 million $ now accounts for about 40% of the required amount of 1,7 billion $ for the mine extension.

At Vale, we firmly believe that nickel is a safe alternative for electric vehicles in terms of cobalt, which is why we want to preserve the "optionality of nickel". The expansion will increase the mine's annual production by 45 000 tons of nickel, 20 000 tons of copper and 2600 tons of cobalt. The legal validity of the transaction is foreseen for the beginning of the year 2021.

Umicore: The big but sustainable cobalt supplier

Umicore is a materials giant with an annual turnover of more than 3,3 billion €. The company sells mainly through emission reduction catalysts, rechargeable battery materials and recycling.

The company's comments on attempts to stop using cobalt in electric vehicle batteries seem justified. On the other hand, it is also noteworthy that the company emphasizes this despite its status as "the first and only cathode material producer capable of offering customers clean and ethical production certified materials in the rechargeable battery supply chain "Marketed. To keep that promise, the company gets its cobalt from the Organization for Economic Cooperation and Development (OECD) program, which in turn is audited by PriceWaterhouseCoopers.

"The growing scarcity of metals and increasing societal pressure to extract resources in an ethical and environmentally responsible manner has made supply chains increasingly traceable. An increasing number of [car makers and parts suppliers] are therefore looking for a closed-loop approach, as in Umicore, "according to the company's statements in its last annual report. Building on this, the company has formed technology and research alliances with BMW and Audi.

Sherritt International: Cobalt from Cuba and Madagascar

Sherritt International is a nickel producer with mines in Canada as well as in Cuba and Madagascar. The company is relentlessly focused on cost structures. At Sherritt, Cobalt has a larger share of the company's portfolio compared to other companies: metal sales rose 24% to 160 million last year. Kobalt accounted for about a third of its annual revenue of $ 498 million last year.

The company offers its investors an incomparable offer. The primary cobalt business consists of a joint venture via the Moa mine in Cuba. There, nickel and cobalt are produced. Due to the tensions between Cuba and the US, Sherritt has to circumvent US sanctions, which prohibit business relations between the two countries. The company blends nickel and cobalt in sulphides and ships them to its refining plant in Fort Saskatchewan, Canada. There it is refined and can then be sold freely on the other markets. The company's main customers are from Europe, Japan and China.

Last year, Moa delivered the set lower production limit of 3234 tonnes of cobalt (baseline). For 2019, production is expected to increase to 3300 to 3600 tonnes. The increase in production is a direct result of investments made last year in new equipment and the shortening of the transport route. The Canadian refinery is also prepared for a potential production increase with an annual capacity of 3800 tonnes.

The other part of his cobalt business is the company with the Ambatovy joint venture in Madagascar. And also this country can be problematic. The set production target of 3100 to 3400 tons could not be reached last year due to cyclones and hurricanes. Instead, only 2852 tons (initial value) were promoted. However, the company said that 2019 will see an improved year-on-year result should no unforeseen weather catastrophes occur.

Cobalt 27 Capital: Cobalt Streams, Licenses and Investments

Cobalt 27 Capital offers investors another way to benefit from Cobalt. As an investment vehicle for metals needed in electrical applications, the company is building a portfolio of investments in the cobalt material itself as well as nickel streaming, licenses and mine shares. Overall, the company owns about 2900 tons of cobalt. This is based on 2193 tons of high-grade material and 713 tons of standard cobalt.

Its largest cobalt streaming contract (the company pays in advance for future cobalt production to act as an alternative provider of funds to those developing the cobalt mines) has closed the company in cooperation with Vale and Voisey's Bay Mine, which at the start of the year closed 2021 to enter into force. The other major deal is the immediate purchase of Highlands Pacific, an Australian company with more than 11 000 tons of cobalt resources. Highlands Pacific holds a 11,3% stake in the Ramu Nickel Mine in Papua New Guinea with the option to earn an additional 9,25% at market value. In addition, the company owns 20% of the Frieda River Mine, which is considered the country's largest undeveloped copper-gold project and among the top ten mines in the world.

In its latest financial report for the past nine months to the end of September 2018, the company posted investment losses of $ 16,1 million. By comparison, 8,2 $ million was up in the year before.

Wheaton Precious Metals: a larger and diversified precious metal streaming company

Wheaton is one of the world's largest precious metal streaming companies and Vale's contract partner for future cobalt sales from Voisey's Bay Mine. From the project start in 2021, the company owns 42% of the cobalt production.

Wheaton is one of the world's largest precious metal streaming companies and Vale's contract partner for future cobalt sales from Voisey's Bay Mine. From the project start in 2021, the company owns 42% of the cobalt production.

However, this agreement is just one of 28's other streaming contracts, 19 with mines already in operation, and 9 mines being prepared. Prior to the conclusion of the latest agreement, the company has already done business with Vale, including the Goldstream for its Salobo mine. It also owns a silver stream at Glencore's Antamina Mine and Goldcorp's Peñasquito Mine.

Wheaton currently has proven and probable reserves of 32,6 million pounds, but the company also offers 11 million ounces of gold, 540 million ounces of silver, and 660 000 ounces of palladium. Wheaton and other similar companies, such as Cobalt 27, are buying the metal at today's market prices and receiving it in the future, hoping to then earn higher prices for these important metals.

African Battery Metals: A player in early project phases in safer regions

African Battery Metals is listed on the stock market AIM. It focuses on its nickel and cobalt projects, which it acquired last year in Cameroon and the Ivory Coast. Even though these projects are still at a very early stage, it is still worth taking a look at the company. According to his own statements, four of his licenses in Cameroon constitute "almost one of the largest undeveloped cobbler reserves in the world." In Ivory Coast, the company has acquired the irrevocable right to use up to 70% of the amount of cobalt, chromium and nickel from the Lizetta II project. Should the project be successful, the company was able to mine new significant cobalt sites outside the DRC and in more stable African regions. Shares in the Kisinka Copper-Cobalt Project, where it began exploration, have access to the DRC.

African Battery Metals is listed on the stock market AIM. It focuses on its nickel and cobalt projects, which it acquired last year in Cameroon and the Ivory Coast. Even though these projects are still at a very early stage, it is still worth taking a look at the company. According to his own statements, four of his licenses in Cameroon constitute "almost one of the largest undeveloped cobbler reserves in the world." In Ivory Coast, the company has acquired the irrevocable right to use up to 70% of the amount of cobalt, chromium and nickel from the Lizetta II project. Should the project be successful, the company was able to mine new significant cobalt sites outside the DRC and in more stable African regions. Shares in the Kisinka Copper-Cobalt Project, where it began exploration, have access to the DRC.

Red Rock Resources: Everything on Cobalt

Red Rock Resources is also one of the smaller early players, but completely relies on cobalt. The company currently has shares in gold, copper and other commodities in addition to cobalt. However, attention has been drawn to the development of one of its three copper-cobalt fractions in the DRC. The company controls slightly more than 50% of the assets.

The company hopes that the Musonoi stake will prove to be a "real asset" so that it "can part with activities and assets that are not core business". In simpler terms, Red Rock hopes to focus on its assets in the DRC and sell its other shares. But investors can be reassured because the company has other options that it can access should efforts in the DRC fail.

Horizons Minerals: Diversification of nickel and cobalt

Horizonte Minerals acts primarily as a nickel producer, focusing on two scalable, high-quality Tier 1 nickel deposits in Brazil. These are divided into two projects: the Vermelho Nickel Cobalt Project, which was acquired last year, and the already more advanced Araguaia Ferronickel Project.

At the beginning of the year 2018 Vale has bought the Vermelho project. It was part of Horizon's strategy not only to buy another large nickel deposit to complement its portfolio, but to gain direct access to the cobalt that can be processed incidentally. The company is currently conducting a feasibility study for the project, which plans to release 2019 before the end of the year. It outlines the project parameters (estimated capital expenditure, production capacity, etc.) and possible economies (potential revenues and costs). It is also the first serious project validation. Although this is a preliminary report, good personal finance specialists (PFS) can see stock prices of smaller mining companies skyrocket.

Source: IG.com | ,