Australian lithium mines fight low prices

MELBOURNE 03.09.2019/XNUMX/XNUMX - After spurring lithium production over the past five years to take advantage of rising prices, Australian producers are now struggling to cut supply as prices fall due to falling demand in the world's largest electric vehicle markets.

The miners say they are already feeling the difficult market conditions as demand for the battery component has declined after Beijing changed subsidies for electric vehicle manufacturers and tensions in world trade have increased.

The last round of last week's quarterly reports showed a pattern of lower sales as battery makers had to cut demand while sales made at lower prices.

Alita Resources consulted consultants last week following a failed restructuring effort, Pilbara Minerals has lowered its third-quarter revenue forecast and halved Galaxy Resources' first-half revenue year-over-year.

“The mood is very bad. Unless market sentiment changes on the trade war, a major recovery in the Chinese auto market will be difficult to see, ”said Argonaut Securities analyst Helen Lau.

“So it's very, very difficult on the supply side. There has to be a certain consolidation among the lithium miners. "

Australia produces about half of the world's lithium from hard rock lithium concentrate, called spodumene, which is mainly shipped to China for processing.

China's largest lithium producer, Ganfeng Lithium Co, a large spodumene consumer, saw its first-half profit decline by 59% last week, saying that it expected Australian hard rock lithium prices to continue to fall.

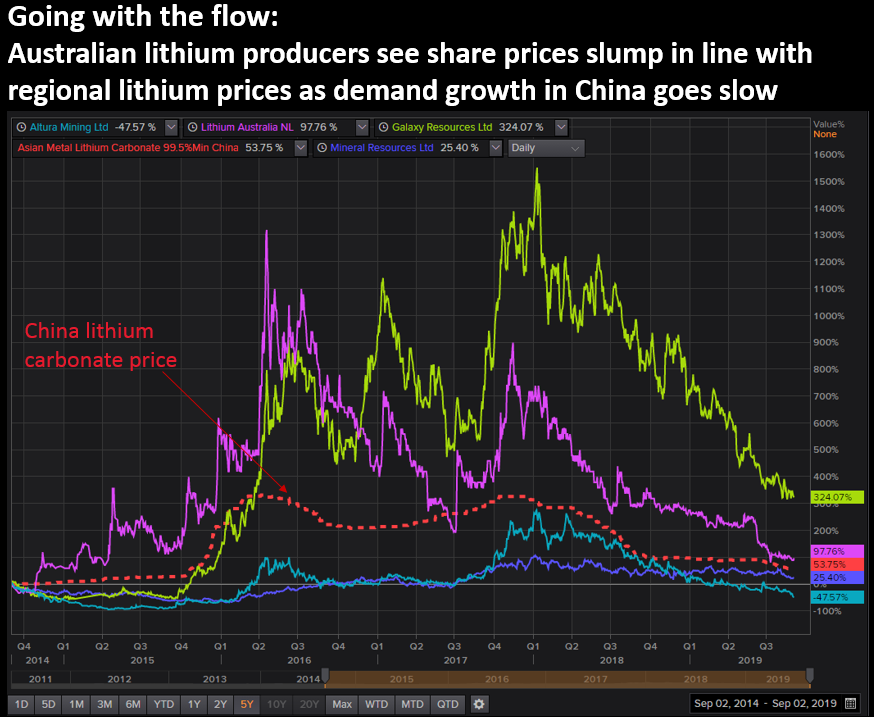

Shares of Australian mines such as Mineral Resources, Galaxy Resources, Altura Mining, Lithium Australia and Pilbara have fallen between 15% and 68% this year compared to a fall in the price of spodum 20%.

Australia's lithium miners have been plagued with price issues for two years as Chinese prices fell more than 20%. (Graphic: Reuters)

The outlook for the market remains very subdued, ”said Simon Hay, CEO of Galaxy Resources, on a call for earnings last week, pointing to rising inventories.

Hard rock lithium converters in battery chemicals in China are working on supplies for about four months, he said.

This has slowed sales to foreign suppliers. Galaxy sold 2019 44.630 tons in the first half of the year, compared to 90.000 tons last year, at an average price of 584 US dollars, compared to 940 US dollars the previous year.

Pilbara Minerals has cut its investments to cut costs and reduce new development projects.

Australian lithium producers see price declines in line with the Chinese lithium price. (Graphic: Reuters)

Altura Mining was temporarily halted Friday after a fall of up to 30% on two days, but said it had strong sales and pointed to the overall market weakness.

Further afield, however, broker Canaccord said he has reduced his predictions for annual spoduman concentrate production by about 30% to 2025.

"Challenging market conditions for concentrates have caused numerous operators to re-evaluate production plans," she said.

Reporting by Melanie Burton; Editing by Richard Pullin Translation and editing: Institute for Rare Earths and Metals