Electric mobility will be a major key industry in the next few years. The course is already being set today.

Battery raw materials should be particularly observed in 2020

2019 was a year that was largely marked by falling prices and disappointing performance in both the EV (electric vehicle) and consumer electronics sectors, according to research firm Wood Mackenzie on Monday.

But interest in electrification shows no signs of diminishing. Wood Mackenzie said the value chain of a new “green” automotive industry is being built, from mines and refineries to the manufacture of cells and components.

Although the industry is still in its infancy, the investments and business that will be made in the coming months will be critical to the potential of electric vehicle adoption in the next decade.

According to Wood Mackenzie, there are five things to consider in 2020:

1. The most important EV markets will grow again.

The world's largest EV market shrank in 2019. According to the Chinese Association of Automobile Manufacturers, sales of electric vehicles reached 1,206 million last year, which is about 4% lower than in 2018 and 20% below China's annual target. In the USA, the decline of around 10% year-on-year was also remarkable. A sluggish global automotive sector and changing subsidies have certainly contributed, but it is clear that EVs are not yet ready to stand on their own two feet.

This year, several major automotive manufacturers are launching mass market EVs on special platforms to overcome the range and cost barriers. While Wood Mackenzie expects significant volumes of these vehicles to hit the market in the second half of the year, annual sales of electric passenger vehicles are likely to remain below 3 million. China's move to put an end to the end of subsidies for electric vehicles this year will support EV sales, but it also shows how sensitive the EV market is still to subsidies and incentives.

2. Bigger and better batteries

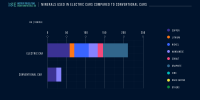

Cobalt prices skyrocketed in 2018 and the trend toward high nickel and low cobalt batteries has increased. Last year, China started the first large-scale production of so-called NMC 811 cells, which are used in the automotive sector. This year, Wood Mackenzie expects that only a handful of EV models outside of China will opt for high energy density technology until the security issues are fully resolved. Within China, 2020 could be the year in which the new LFP chemicals will make a comeback as significant improvements in energy density make LFP a viable option.

The fear of range continues to keep many consumers from buying electric vehicles, as large ranges are more reserved for luxury vehicles in the luxury class. Car manufacturers are aware of this, and almost every new model has a larger battery that offers more kilometers per charge. Wood Mackenzie expects this trend to continue in the short term. As with most EVs, the models with the best equipment, which usually use the largest battery pack, are initially sold. The average battery size could increase in the next few years as these batteries are launched from the start.

3. Lithium - another bad year

Not even lithium manufacturers expect the lithium market to recover this year. 2019 was particularly weak compared to many expectations of increasing demand, and a surplus in the market pushed prices down. Almost every lithium reference price fell by at least 30% and the reported selling prices followed the same trend. Wood Mackenzie predicts a price decline that will extend over the next twelve months. A temporary lull in the market could be exactly what the LME needs to launch its new lithium contract this year. The contract will not be welcomed by all lithium players; However, Wood Mackenzie believes that it is a step forward to increase the transparency of lithium prices.

Oversupply was the general topic in 2019, and despite several closings and expansion cuts, Wood Mac analysts don't expect shortages in the short term. The production of hard rock has shown how quickly a spodumium concentrate can be put into operation, but a greater degree of discipline is now required for 2020. Some producers with higher costs will feel the pressure this year as spodumene prices do not recover.

The economic viability of new projects is now looking less interesting, and young mining companies will increasingly need to highlight their environmentally friendly properties and strategic locations, which is being examined very closely in the battery and electrical energy sector.

In terms of solar energy, supply growth was higher in 2019 than in 2018. The brine companies will have to keep their share of the market this year as well. Low prices may not weigh so heavily on brine manufacturers, who are usually at the lower end of the cost curve and have previously produced at this level. The commissioning of South American brines will most likely be slower than planned, with water rights and technical challenges remaining the main issues.

4. Cobalt - can we fill the void?

Cobalt production in the DRC declined over the past year as the industry struggled with both the decline in demand for electric vehicles and electronic equipment and "digestive disorder" after the huge supply reaction in 2018 that overcrowded the supply chain.

The weaker fundamentals naturally impacted price levels, with the LME cash price averaging $ 33.290 / t ($ 15,1 / lb) annually. This weak price environment and higher operating costs prompted industry leader Glencore to upgrade its Mutanda mine to care and maintenance from the end of last year. With Mutanda currently the largest cobalt mine in the world, the company has left a fairly large void to fill. Wood Mackenzie says the company is ready, but it does involve risks.

The Mutanda suspension will exacerbate Glencore's other operation in the DRC, Katanga. Katanga has addressed uranium quality issues over the past year, but interim solutions seem to be bearing fruit.

Wood Mackenzie analysts estimate that about 5 kt of cobalt in hydroxide may have been exported last year, while production of 14 kt. 2020 will be targeted from Katanga, with export volumes depending on the continued successful implementation of programs to remove bottlenecks.

Aside from Glencore, the most likely source of "replacement" buoys is ERG. Your Metalkol RTR system started up only slowly last year - both in terms of quality issues and the poor market. We estimate exports to only about 3,4 kt in 2019, compared to a capacity of ~ 14 ktpa. However, RTR will have to at least double deliveries in 2020 if we are to avoid a large deficit. Other key players, such as CMOC's Tenke Fungurume, are unlikely to be able to increase production significantly, while new supplies from Chengtun and the recently started operation in Deziwa will also be needed to meet growing demand.

Wood Mackenzie believes production will return to 2018 levels. Analysts are assuming a fictitious deficit of around 2 kt this year. Wood Mackenzie believes this is necessary in order to continue to deplete the inventories that have accumulated in the cobalt value chain. The company believes there is a price risk this year if the “main producers” fail to ramp up, so higher prices are required to create an incentive for more expensive supply in the market.

5. Graphite - based on the Balama drama

While key “battery metals” such as lithium and cobalt have suffered from slowing EV sales in the important Chinese market, the basics are more complex with graphite - a 1 million-tonne industry driven primarily by the steel sector. In the natural flake market, exports from Syrah Resources' Balama Mine in Mozambique have grown steadily over the past year. This gradually flooded the previously isolated Chinese flake market and weakened the price level over the course of the year. The magnitude of the oversupply led Syrah to cut its own production and forecast for 2020 to 120-150 kt in the final quarter.

With the beginning of 2020, there are many questions related to the Flake market. Does the natural graphite industry really need a mine the size of Balama right now - which at full capacity (350 ktpa) would be larger than the current global consumption of natural graphite in batteries? And is there a future for the other flake graphite projects that want to start production in this environment - especially in view of the seemingly renewed interest in synthetic graphite?

The medium-term outlook for graphite remains strong, says Wood Mackenzie, although disruptive technologies such as silicon-based or even lithium-metal-based anodes are unlikely to dampen growth in the near future. However, since this still young sector is already overwhelmed with the offer, 2020 is likely to be another challenging year. As margins have come under pressure and an increasing focus on sustainability is promoting ex-Chinese procurement, many graphite mines, including Syrah, will continue to shift the value chain down to high-purity spheroidal graphite.

ISE - January 2020