JPMorgan benefits from the tension in the Chinese nickel market

JPMorgan Chase & Co. has traded around $ 100 million in nickel last year, according to people familiar with the situation, as the company benefited from an increase in prices due to a supply shortage triggered by China.

The year of the nickel blowout underscores JPMorgan's growing dominance in a corner of the commodity markets where rivals have withdrawn. The bank has become the primary financer for large base metal businesses, from the Chinese purchases of nickel that sparked last year's price hike to auto insurance deals that require the metal for electric vehicle batteries.

A JPMorgan spokesman declined to comment.

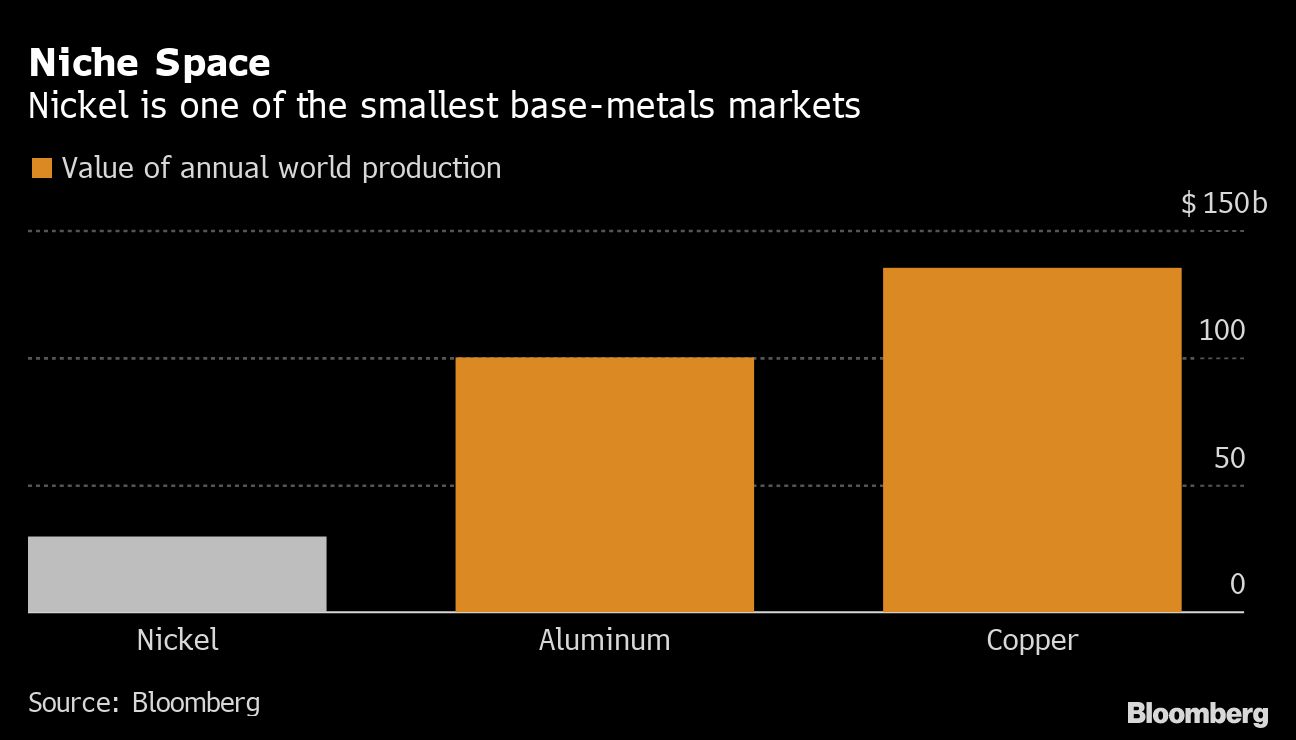

Nickel, usually a niche market dominated by stainless steel factories, became the hottest metal in the world in 2019, when prices rose two-thirds within a few months.

Initially, the movements were spurred on by the threat of an ore ban in Indonesia. But prices only really rose when leading stainless steel maker Tsingshan Holding Group Co. pulled large amounts of nickel from the London Metal Exchange, fueling concerns about a supply shortage.

JPMorgan was one of the banks that co-financed the Chinese company's purchases, Bloomberg reported at the time. While these transactions weren't a major profit driver, separate positions related to long-term auto hedge deals became lucrative for the bank as the market recovered, people said.

Their central role in both businesses is indicative of the fact that JPMorgan has become an important broker in the base metals markets after the departure of other banks. Goldman Sachs Group Inc. and Societe Generale SA were among the last to withdraw.

According to experts, JPMorgan is often the largest trader on the London Metal Exchange in terms of open positions.

The growth in nickel helped the company's total income from trading in fixed-income securities, a division that also includes commodities, rise by 13% to $ 14,4 billion in 2019, the largest increase among global investment banks represents.

Nickel accounted for about half of JPMorgan's base metal team's trading income last year, while the raw materials department totaled about $ 1 billion, the respondents said. JPMorgan does not publicly report the results of its commodities trading business.

The bank's exceptionally high profit from trading nickel - one of the smallest markets for base metals - raises the profile of its main nickel trader, Daniel Amsbury, known by the nickname “Disco” in the closely-knit London metal market.

Mining News / ISE - March 2020