Rare earth production in Canada starts with 2020

Rare Earth Elements (REEs) are a group of 17 elements that are called lanthanoid series in the Periodic Table of the Elements. Although scandium and yttrium are not true REEs, they are also included in this categorization because they have similar properties to the lanthanides and are always in the same ore bodies. REEs are key components in many electronic devices that we use in our daily lives as well as in a variety of industrial applications.

Important facts to rare earths

- Canada hosts some of the most advanced REEs exploration projects in the world.

- China is the world's largest producer of REEs, accounting for almost 90% of the world's annual production of an estimated 135.000 tonnes.

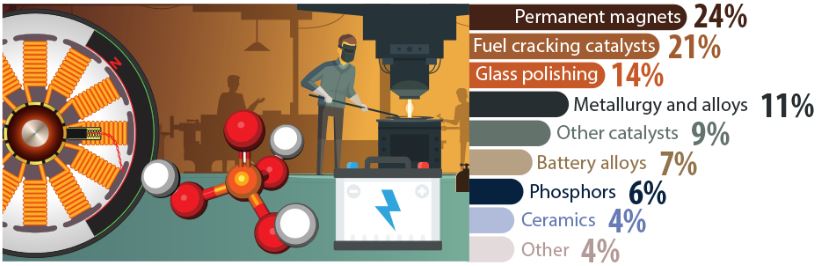

This bar chart shows the main industrial uses of REEs as of 2017. The largest use was made of permanent magnets (24%), followed by fuel cracking catalysts (21%), glass polishing powders (14%), metallurgy and alloys (11%), other catalysts (9%), battery alloys (7%), phosphors (6%), ceramics (4%) and other products (4%).

Use of rare earths

Rare earth elements (REEs) are used in a variety of industrial applications, including electronics, clean energy, aerospace, automotive, and defense. The worldwide demand for REEs was estimated 2017 at around 136.000 tons.

Manufacturing permanent magnets is the largest and most important end use for REEs, accounting for 24% of total consumption.

Permanent magnets are an integral part of modern electronics used in mobile phones, televisions, computers, automobiles, wind turbines, jets and many other products. REEs are also commonly used in high technology and "green" products because of their luminescent and catalytic properties.

Production of rare earths

While Canada is not a current producer of REEs, it has some of the world's most advanced exploration projects. Canada hosts 20's 63 advanced REEs projects, which are being pursued by Technology Metals Research, a company focused on markets and the analysis of critical and strategic materials such as REEs.

REEs are classified as either "easy" or "difficult":

Lightweight REEs (lanthanum, cerium, praseodymium, neodymium, promethium, samarium, europium, gadolinium and scandium) are produced worldwide in abundance and are in over supply.

Heavy REEs (Terbium, Dysprosium, Holmium, Erbium, Thulium, Ytterbium, Lutetium and Yttrium) are mainly produced in China and have limited availability. Global efforts to develop new resources continue globally.

Many of Canada's most advanced REE exploration projects contain high concentrations of the world's estimated heavy REEs used in high-tech and clean energy applications.

| projects * | City / State | Expected REE production in tons per year | Expected production start | Proportion of heavy REE |

|---|---|---|---|---|

| Buckton, DNI Metals | Alberta | Unspecified | > 2020 | 24 |

| Foxtrot, Search Minerals | Newfoundland and Labrador | 10,000 | > 2020 | 21 |

| Nechalacho, Avalon | Northwest Territories | 10,000 | > 2020 | 28 |

| Kipawa, Matamec | Quebec | 6,000 | > 2020 | 36 |

| Strange Lake, Quest | Quebec | 12,500 | > 2020 | 47 |

| Grand-Vallée, Orbite Aluminae | Quebec | 1,000 | > 2020 | 20 |

* While Canada's REE resources continue to exist, some of the companies developing these resources may no longer be liquid or have exploration efforts focused on other mineral deposits.

In recent years, the steady, reliable and safe supply of critical metals has become increasingly important to large industrialized countries that want to maintain their industrial base and develop advanced technologies such as clean energy. Against this backdrop, Canada, with its significant critical metal reserves, has the potential to cover part of the global demand for critical metals. However, moving from promising minerals to marketable products requires investment in R & D and expertise to address the complex technological challenges involved in the production, separation and processing of critical metals and to better understand the global market for these key raw materials.

Chromium deposits in the Ring of Fire of Ontario have a production potential that could make Canada a major global producer, processor and supplier of products containing the critical metal chromium.

Rare earth elements are important minerals that give Canada the opportunity to enter an emerging and globally strategic market. As they are needed for the manufacture of all high-tech, clean energy, aerospace, automotive, defense and many other industrial products. While rare earths are geologically abundant, they are economically recoverable in just a few mineral deposits.

Research and development close important knowledge gaps to support the sustainable development of REE and chromite resources in Canada by developing and implementing innovative processes that improve efficiency and competitiveness while addressing potential environmental issues. Research and development will be combined with strategic market and economic analysis to help Canada become a key player in these two industries.

International context

China is the world's largest producer of REEs, accounting for almost 90% of world's annual production, estimated at 135.000 tonnes. The remaining 10% is shared by four other countries: Australia, Myanmar, Russia and Malaysia. China remains practically the only producer of the estimated heavy REEs.

| Rank | Country | x1.000 tons | Percentage share |

|---|---|---|---|

| 1 | China | 116.9 | 86.6% |

| 2 | Australia | 13.4 | 9.9% |

| 3 | Myanmar | 2.3 | 1.7% |

| 4 | Russia | 2.2 | 1.6% |

| 5 | Malaysia | 0.3 | 0.2% |

| Total | 135.0 | 100.0% |

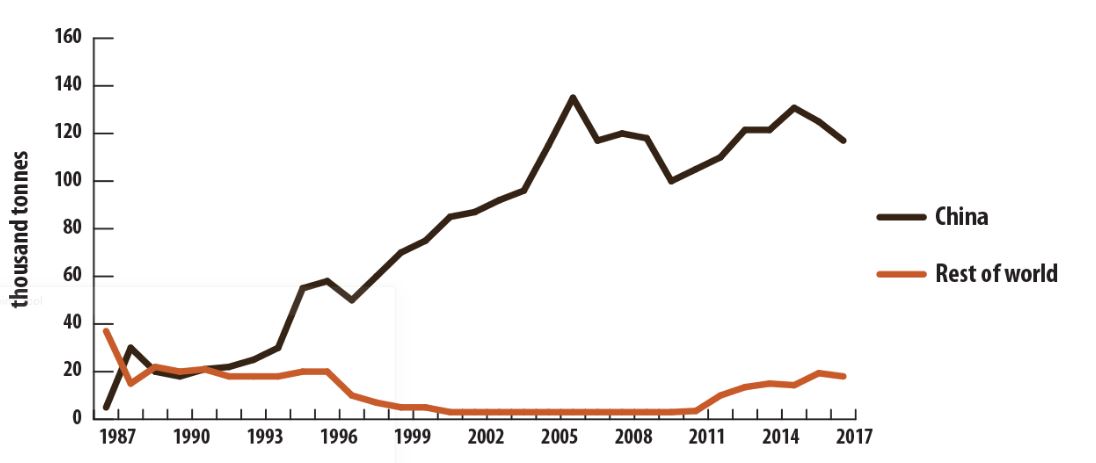

The United States was the world's largest supplier of REEs until the emergence of China in the mid-1990s. China was virtually the only REE supplier in the world to 2012, as the now bankrupt US manufacturer Molycorp Inc. and the Australian company Lynas Corporation Ltd. started commercial production.

This 30 annual line chart shows REEs production in China compared to the rest of the world. In 1987, China's production was estimated at 5.000 tons, while the rest of the world had an estimated production of 35.000 tons. By 2005, Chinese production is said to have reached 135.000 tons, while the rest of the world produced 3.000 tons. China produced an estimated 2017 tons of 117.000 while the rest of the world produced an estimated 18.000 tons.

Institute for Rare Earths and Metals Arndt Uhlendorff- August 2019