Outlook for the Australian iron industry 2020

Australian miners work hard to mine top quality iron ore

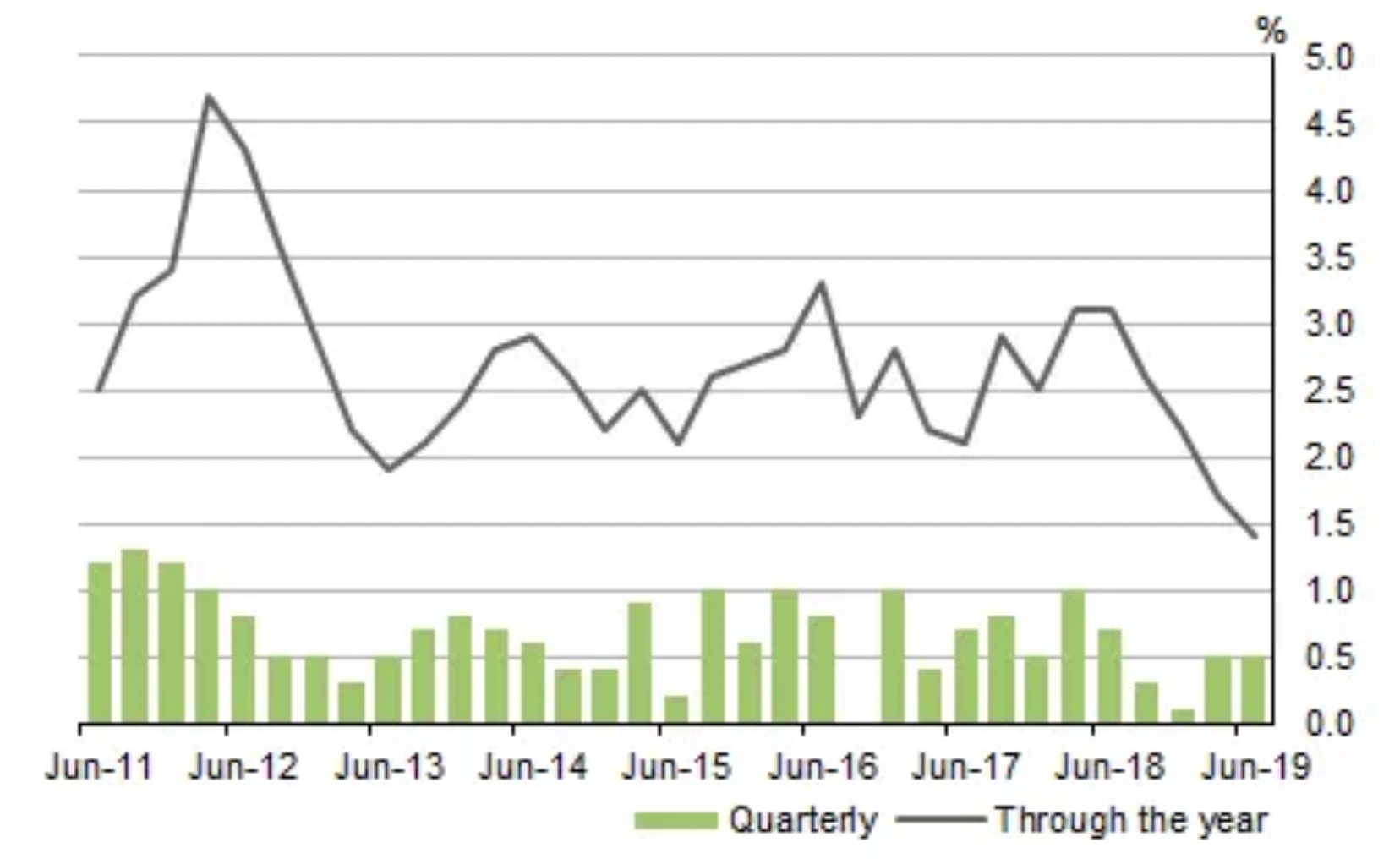

Lately the Price for iron ore up to $ 100 a tonne, up more than 44% since the beginning of the year. Many Australian mining authorities predict that the iron ore price is expected to break through $ 110 a ton in the second half of this year. Commodity analysts at UBS Group AG have raised the forecast iron ore price for the second time and assume that the average iron ore price this year will be $ 83 per ton. Iron ore prices have improved in recent days since bottoming out, but are still well below the $ 190 a ton price in February 2011.

Influenced by the rapid recovery in iron ore prices, the large mining companies in Australia got a lot of cash and began to intensify the exploration and mining of new mines. According to Australia China Business News, the third largest Australian iron mine, Frost Metals Group (FMG), plans to invest around $ 287 million in the development of a new mine in the Queens Valley of Pilbara. The investment is expected to increase the quality of iron ore products to meet market demand while improving corporate competitiveness.

As the global commodity markets picked up again, many investors have returned to the mining sector. The data shows that the number of M&A deals by publicly traded companies in Australia has reached as much as $ 1 billion since July 12 last year, more than double what it was two years ago and the highest in six Years represents.

Currently, the main players in the Australian iron ore M&A deal are the midsize companies in the industry. In the past two years, iron ore import and export prices, funding levels, and market activities have increased again, continuously bringing OTC funds into the industry. According to the Perth consultancy, which specializes in dealing with SMEs, market transactions have been piling up for several days, and the company's staff has never been so busy in recent years. More and more resource-based small businesses believe that the best way to invest right now is to acquire existing businesses instead of investing again. Therefore, the most common route through mergers and acquisitions is through mutual equity ownership or the establishment of joint ventures with smaller companies.

Although some people believe that iron ore 's tremendous contribution to Australia' s economic prosperity has become history, some mining companies have increased their enthusiasm for expanding production with the recovery in iron ore prices over the past two years. As a result, BHP Billiton, Rio Tinto and FMG have expanded the production scope of the Western Australian mining area. Australian mining companies' share of China's iron ore imports is expected to increase from 43% in 2010 to around 62% this year. At the same time, however, the supply of high-quality iron ore from Brazil continues to increase on the international market. Therefore, supply and demand in the market will saturate in the future.

The new dimension of the three major Australian mining giants is the calling card of the entire iron ore industry, and the changes in the market also show that the Australian mining industry is undergoing major changes. The three major Australian mining companies plan to build new mines in Pilbara over the next five years. This region is one of the most important Australian areas for high quality iron ore and is expected to require between $ 5 and $ 10 billion in investments. BHP Billiton's directors are reported to have recently approved a $ 2,9 billion South Wing iron ore project that will produce 80 million tons of iron ore annually, which is nearly a third of BHP's current production in Pilbara. FMG announced that they will spend $ 127 million on the purchase of a new mine, and Rio Tinto will build a new mine by the end of this year, meaning that the three major Australian iron ore producers will be building new mines in the same area at the same time ,

This year BHP Billiton and Rio Tinto intend to slightly reduce exports by an estimated 290 million tons and 360 million tons, respectively. However, the total export volume of Australian iron ore is expected to increase from 865 million tons last year to 895 million tons in 2020, to peak and stabilize at around 2023 million tons after 884.

Although the emerging market has great potential, the market now needs more high quality iron ore and the transaction price consolidates in a relatively tight space of $ 60 to $ 80 a ton. China continues to be the main export destination for Australian iron ore, and growing demand in China for iron ore quality has also prompted the Australian iron ore industry to supply more high quality iron ore. Therefore, only by improving the technical ore processing machine and reducing costs can companies achieve higher returns.

Text and image: Linda Zhou for ISE

Translation: ISE - January 2020