The US is finding it difficult to break its dependence on Chinese rare earths

The US Department of Defense has just approved funding for two rare earth separation facilities on US soil.

It's a small step towards the Trump administration's stated goal of breaking the country's reliance on Chinese supplies of critical minerals.

But the Pentagon's direct involvement underscores the scope of the task involved in creating a non-Chinese rare earth supply chain from scratch.

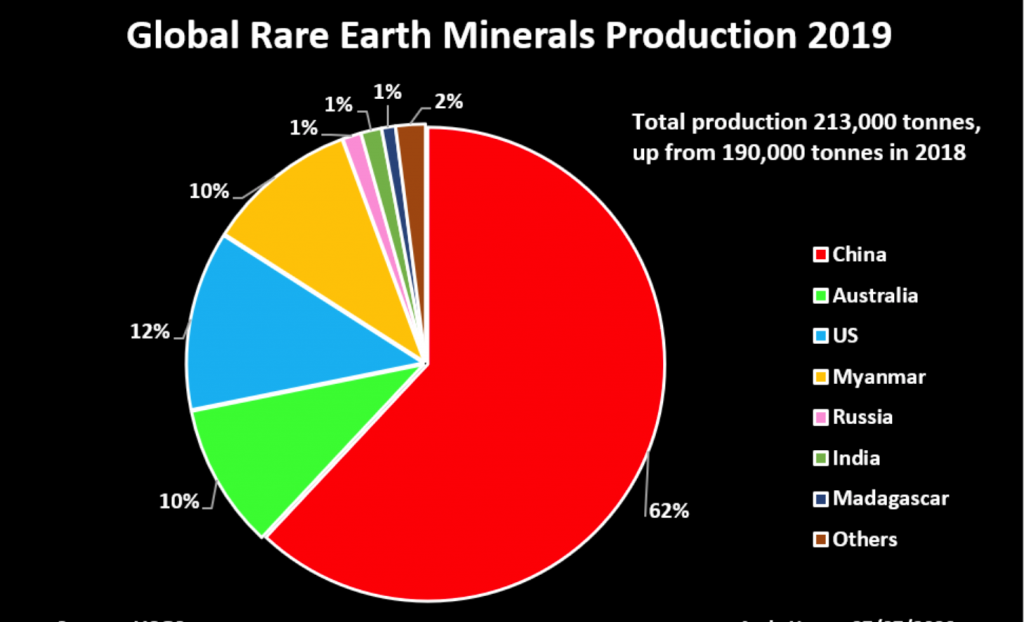

The United States was almost entirely dependent on imports of rare earth compounds and metals for the past year, just as it was the year before and the year before. According to the United States Geological Survey (USGS), China remained the largest supplier with around 80% of all imports.

This reliance on China for minerals in critical uses for a wide range of civil and military uses is becoming more problematic as US-China relations deteriorate.

But breaking this, as the United States finds out, requires a mix of direct government support, alliances with like-minded countries, and a long-term focus on the six-step process chain from ore to rare earth oxide

Link the entire production chain

The United States is now producing rare earths in the reopened Mountain Pass mine in California, which was bought out of bankruptcy in 2017 by MP Materials, an investment vehicle supported by US funds JHL Capital Group and QVT Financial.

The mine produced 26.000 tons of light rare earth oxides in concentrated form last year, which according to the USGS accounts for 12% of global production.

China's dominance in the first stage of the global rare earths chain is weakening, which is partly due to the resumption of the Mountain Pass mine and partly to a relocation of the highly polluting heavy rare earth mining from China to Myanmar, which produced 22.000 tons of concentrate last year.

However, China's control of global processing capacity is almost complete, with the exception of Australian Lynas Corp, which operates a separation facility in Malaysia.

What is currently being mined in Mountain Pass will be shipped to China, where it will be refined into concentrate and other products, which will then be shipped back to the United States.

MP Materials is one of three companies selected to receive direct government funding for a separation plant, albeit after a review by its Chinese shareholder, Shenghe Resources.

Meanwhile, Lynas is working with the Texas-based Blue Line on a separation plant for heavy rare earths.

The problem, however, is that the oxide produced in both separation plants may still have to be transported to China for further processing.

As the United States follows China up the rare earths value chain, it recognizes that each segment, through to the end product, poses its own problems.

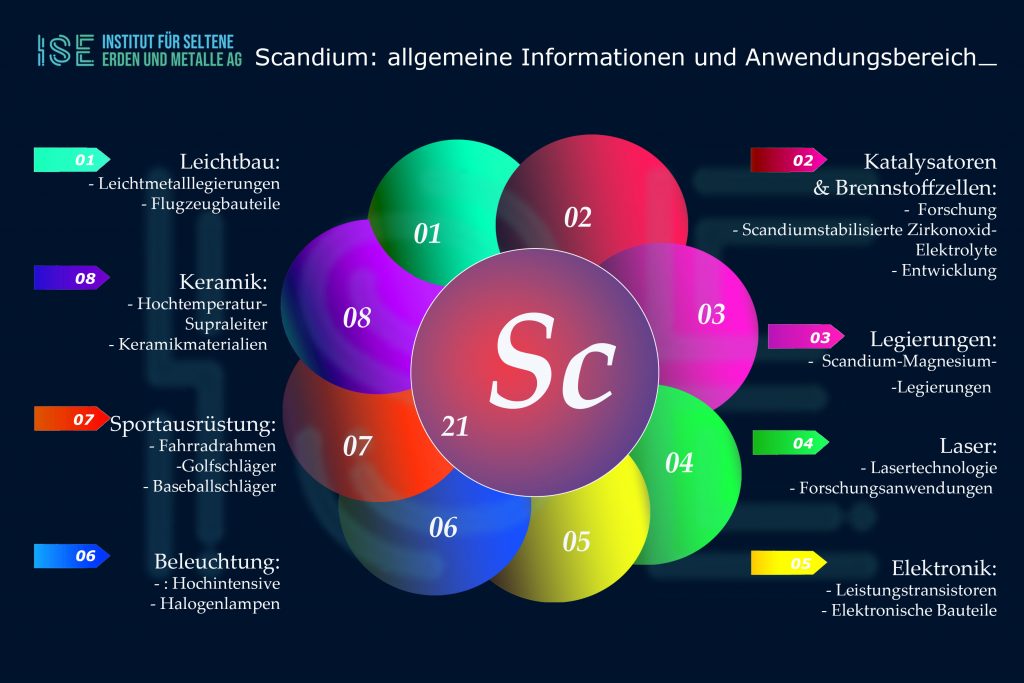

The country currently has virtually no capacity to manufacture neodymium-iron-boron (NdFeB) magnets, the most common end-use for rare earths and an application that is expected to grow exponentially as the global automotive industry shifts to electric vehicles.

Ironically, General Motors, owner of one of two original patents for such magnets, sold the rights to China. Japanese company Sumitomo sold the other to Hitachi, which is now the main supplier outside of China.

"Most of the magnets are made in China," Pol Le Roux, vice president of sales and marketing at Lynas Corp, told Argus Media. ("Argus White Paper: How to build a rare earth supply chain", July 2020).

“And where are we expanding? In the US and Europe? But there is very little magnet production there. So if we make more oxides the only customer is China, ”said Le Roux.

The market isn't big enough

According to Le Roux, customer and government support is required to build the entire chain from mine to magnet.

The market situation caused Mountain Pass to close and the United States to withdraw from the rare earth business.

Market mechanisms are actively working against the restructuring of this domestic capacity, with car companies being given incentives to opt for cheaper Chinese magnets rather than higher-priced, newly established Western rivals.

Lynas' own Mt. Weld project in Australia only made it thanks to the support of the Japanese government, which granted loans and cut interest rates during the difficult start-up phase, Le Roux said.

The main finding is that the Japanese "have a different approach to the supply chain - they place more emphasis on stability of supply," added Le Roux.

The US is catching up, and the Department of Defense law to invest directly in segregation capacities is a recognition of the government's role as a facilitator.

This also applies to the bill proposed by US Senator Ted Cruz, which provides for funding for rare earth mining projects as well as massive tax breaks for companies that use magnets made in the US.

Metallic alliances

The United States is also learning that it will need allies if it is to regain some control over the rare earth sector.

"I think it is clear at this point that there has to be cooperation between countries if you really want to build a supply chain for rare earths outside of China," said Ian Higgins, managing director of British neodymium producer Less Common Metals in conversation with Argus.

Lynas' involvement in the Texas project brings together a rare earth compounds manufacturer with the only company outside of China with experience in separating rare earth concentrates on a commercial basis.

The United States was busy building potential alliances with both Australia and Canada on a number of critical raw materials.

It is pretty clear that they will need Japanese help if they are to fill their home magnet making void.

Not only is Hitachi the only non-Chinese player of this size, but Japan continues to cut ties with China in the rare earths area after it was on the hard end of a Chinese export ban a decade ago.

Japan's support for Lynas during the initial teething problems was born out of this supply shock.

It took Japan a decade to relax China's access to its rare earth supplies, and the United States has a long way to go.

"Billions of dollars worth of supply chains don't move overnight (but) the transition in the supply chain has to happen and it will happen over time," said James Litinsky, co-chair of MP Materials, who also interviewed Argus gave his white paper.

Defense Department funding for MP Materials and Lynas / Blue Line is an important step along the way, but it will be a very long way.

Arndt Uhlendorff, ISE, Mining - August 2020